Question: exam prep need help 450 Chapter 14 Financial Ratios and Firm Performance PROBLEMS 1. Income statement. Fill in the missing numbers on the following annual

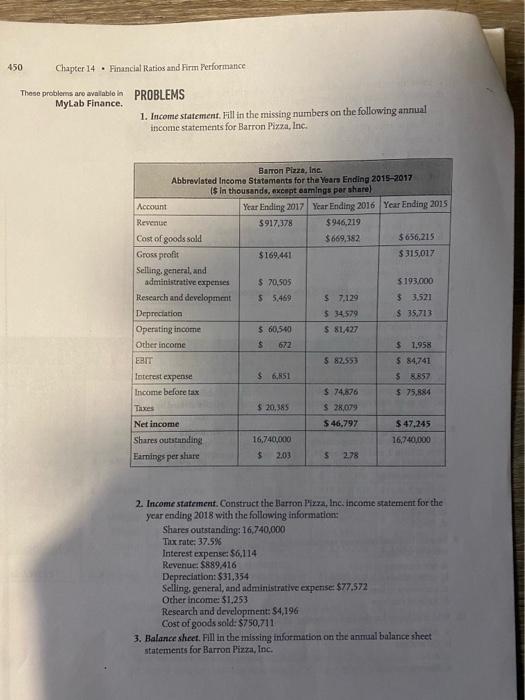

450 Chapter 14 Financial Ratios and Firm Performance PROBLEMS 1. Income statement. Fill in the missing numbers on the following annual income statements for Barron Pizza, Inc. Barron Pizza, Inc. Abbreviated Income Statements for the Years Ending 2015-2017 ($ in thousands, except eamings per share) These problems are available in MyLab Finance. Account Year Ending 2017 Year Ending 2016 Year Ending 2015 Revenue $917,378 $946,219 Cost of goods sold $669,382 $656.215 Gross profit $169,441 $315,017 Selling, general, and administrative expenses $ 70,505 $193,000 Research and development $5,469 $ 7,129 $ 3,521 Depreciation $ 34,579 $35.713 Operating income $ 60,540 $ 81,427 Other income $ 672 $ 1,958 EBIT $ 82,553 $ 84,741 $6,851 $ 8.857 Interest expense Income before tax $74,876 $ 75,884 Taxes $ 20,385 $ 28,079 Net income $46,797 $ 47,245 Shares outstanding 16,740,000 16,740,000 Earnings per share $ 2.03 $ 2.78 2. Income statement. Construct the Barron Pizza, Inc. income statement for the year ending 2018 with the following information: Shares outstanding: 16,740,000 Tax rate: 37.5% Interest expense: $6,114 Revenue: $889416 Depreciation: $31,354 Selling, general, and administrative expense: $77,572 Other income: $1,253 Research and development: $4,196 Cost of goods sold: $750,711 3. Balance sheet. Fill in the missing information on the annual balance sheet statements for Barron Pizza, Inc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts