Question: Examine the balance sheets given in Table 1.3. a. What is the ratio of real assets to total assets for commercial banks? (Round your answer

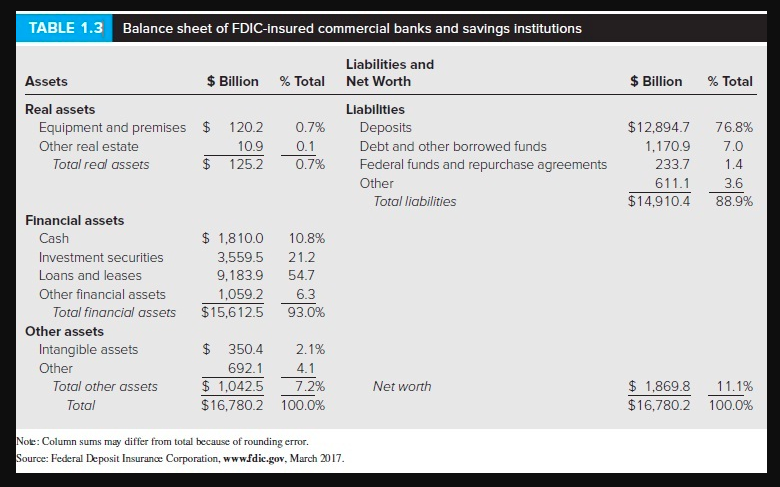

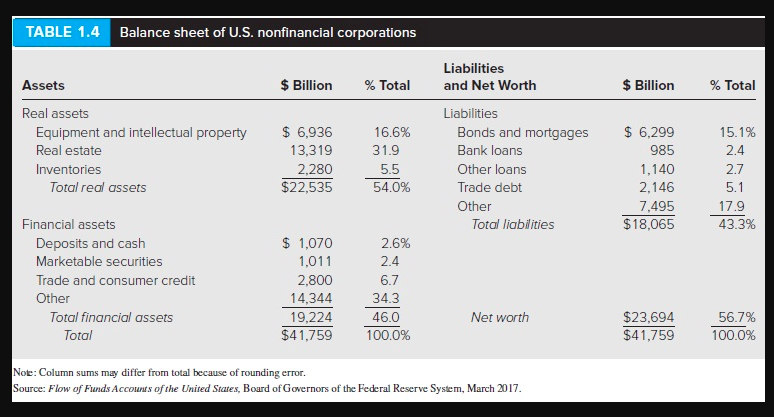

Examine the balance sheets given in Table 1.3. a. What is the ratio of real assets to total assets for commercial banks? (Round your answer to 4 decimal places.) Ratio of real to total assets TABLE 1.3 Balance sheet of FDIC-insured commercial banks and savings institutions $ Billion % Total $12,894.7 1,170.9 233.7 611.1 $14,910.4 76.8% 7.0 1.4 3.6 88.9% Liabilities and Assets $ Billion % Total Net Worth Real assets Liabilities Equipment and premises $ 120.2 0.7% Deposits Other real estate 10.9 0.1 Debt and other borrowed funds Total real assets $ 125.2 0.7% Federal funds and repurchase agreements Other Total liabilities Financial assets Cash $ 1,810.0 10.8% Investment securities 3,559.5 21.2 Loans and leases 9,183.9 54.7 Other financial assets 1,059.2 6.3 Total financial assets $15,612.5 93.0% Other assets Intangible assets $ 350.4 2.1% Other 692.1 4.1 Total other assets $ 1,042.5 7.2% Net worth Total $16,780.2 100.0% $ 1,869.8 $16,780.2 11.1% 100.0% Note: Column sums may differ from total because of rounding error. Source: Federal Deposit Insurance Corporation, www.fdic.gov, March 2017. b. What is that ratio for nonfinancial firms? (Table 1.4) (Round your answer to 4 decimal places.) The ratio for nonfinancial firms TABLE 1.4 Balance sheet of U.S. nonfinancial corporations $ Billion % Total $ Billion % Total Assets Real assets Equipment and intellectual property Real estate Inventories Total real assets $ 6,936 13,319 2,280 $22,535 16.6% 31.9 5.5 54.0% Liabilities and Net Worth Liabilities Bonds and mortgages Bank loans Other loans Trade debt Other Total liabilities $ 6,299 985 1,140 2,146 7,495 $18,065 15.1% 2.4 2.7 5.1 17.9 43.3% Financial assets Deposits and cash Marketable securities Trade and consumer credit Other Total financial assets Total $ 1,070 1,011 2,800 14,344 19,224 $41,759 2.6% 2.4 6.7 34.3 46.0 100.0% Net worth $23,694 $41,759 56.7% 100.0% Note: Column sums may differ from total because of rounding error. Source: Flow of Funds Accounts of the United States, Board of Governors of the Federal Reserve System, March 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts