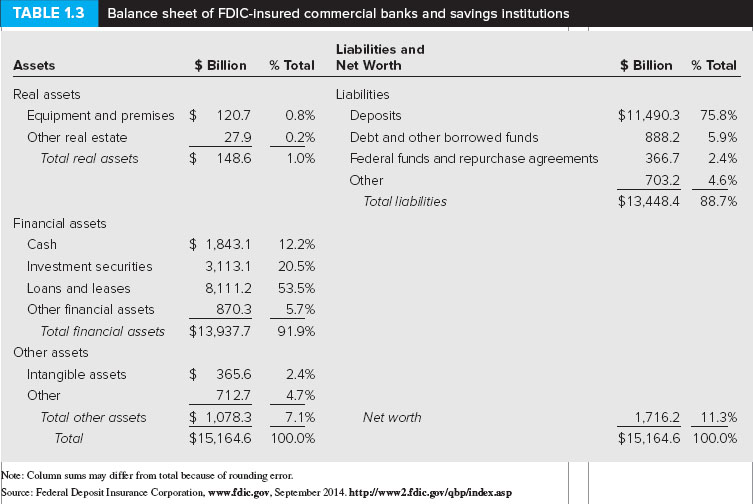

Question: Examine the balance sheets given in Table 1.3. a. What is the ratio of real assets to total assets for commercial banks? (Round your answer

Examine the balance sheets given in Table 1.3.

a. What is the ratio of real assets to total assets for commercial banks? (Round your answer to 4 decimal places.)

Ratio of real to total assets ____________

b. Assuming that the listed intangible assets are not real, what is that ratio for nonfinancial firms? (Table 1.4) (Round your answer to 4 decimal places.)

The ratio for nonfinancial firms ____________

TABLE 1.3 Balance sheet of FDIC-insured commercial banks and savings institutions Liabilities and Assets $Billion % Total Networth $ Billion % Total Real assets Liabilities Equipment and premises Other real estate $ 120.7 27.9 148.6 0.8% 0.2% 1.0% Deposits Debt and other borrowed funds Federal funds and repurchase agreements Other $11,490.3 888.2 366.7 703.2 $13,448.4 75.8% 5.9% 2.4% 4.6% 88.7% Total real assets Total liabilities Financial assets as Investment securities Loans and leases Othe $1.8431 3.1 13.1 8,111.2 870.3 $13,937.7 12.2% 20.5% 53.5% 57% 91.9% r financial assets Total financial assets Other assets 365.6 712.7 1,078.3 $15,164.6 2.4% 47% 7.1% 100.0% Intangible assets Other 1,716.2 $1 5,1 64.6 11.3% 1 00.0% Total other assets Net worth Total Column sums may difer from total because of rounding error. Federal Deposit Insurance Corporation, www.fdic.gov. September 2014. http://www2.fdic.gov/qbp/index asp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts