Question: Example 13 (June 09): Security A 0.80 Security B Risk Free security 1.50 0 Factor 1 Risk Coefficient Factor 2 Risk Coefficient Expected Return 0.60

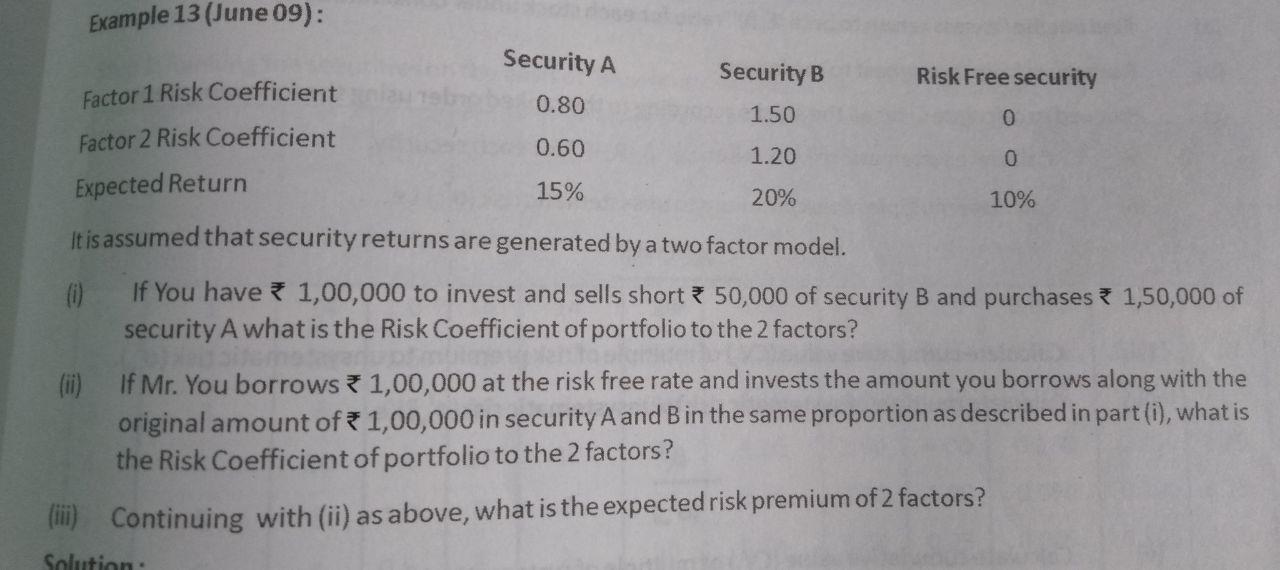

Example 13 (June 09): Security A 0.80 Security B Risk Free security 1.50 0 Factor 1 Risk Coefficient Factor 2 Risk Coefficient Expected Return 0.60 1.20 0 15% 20% 10% It is assumed that security returns are generated by a two factor model. (i) If you have 1,00,000 to invest and sells short 50,000 of security B and purchases * 1,50,000 of security A what is the Risk Coefficient of portfolio to the 2 factors? If Mr. You borrows 1,00,000 at the risk free rate and invests the amount you borrows along with the original amount of 1,00,000 in security A and B in the same proportion as described in part (i), what is the Risk Coefficient of portfolio to the 2 factors? (i) Continuing with (ii) as above, what is the expected risk premium of 2 factors? Solution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts