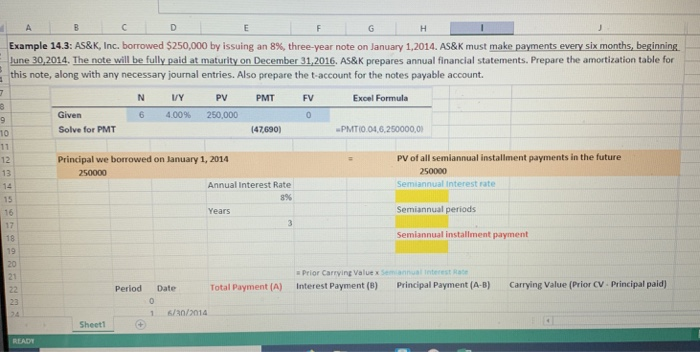

Question: Example 14.3: AS&K, Inc. borrowed S250,000 by issuing an 8%, three-year note on January 1,2014. AS&K must makepayments every s x months beginin une 30,2014.

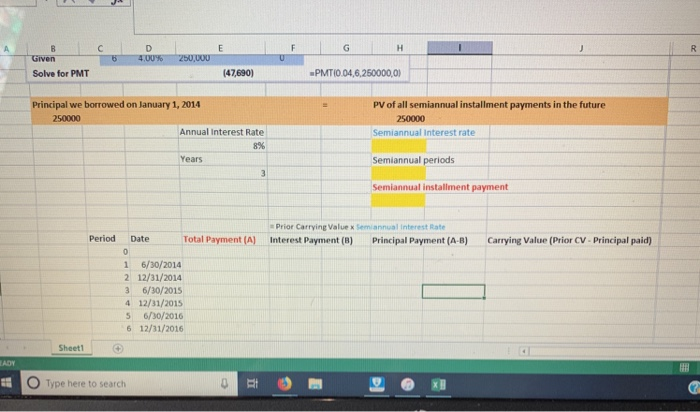

Example 14.3: AS&K, Inc. borrowed S250,000 by issuing an 8%, three-year note on January 1,2014. AS&K must makepayments every s x months beginin une 30,2014. The note will be fully paid at maturity on December 31,2016. AS&K prepares annual financial statements. Prepare the amortization table for this note, along with any necessary journal entries. Also prepare the t-account for the notes payable account. N VY PV PMTFV Excel Formula Given 6 4.00% 250,000 Solve for PMT (47,690) PMTI0.04,6,250000,0 10 12 Principal we borrowed on January 1, 2014 PV of all semiannual installment payments in the future Annual Interest Rate Semiannual Interest rate 15 16 Years Semiannual periods Semiannual installment payment Prior Carrying Value x Semiannual Interest Rate Interest Payment (8) Period Date Total Payment (A) Principal Payment (A-B) Carrying Value (Prior CV- Principal paid) 16/30/2014 Sheet Given Solve for PMT 47,690) PMTI0.04,6,250000.0) incipal we borrowed on January 1, 2014 PV of all semiannual installment payments in the future Semiannual Interest rate Semiannual periods Semiannual installment payment 250000 250000 Annual Interest Rate 8% Years Prior Carrying Value x Semiannual Interest Rate Period Date Total Payment (A) Interest Payment (B) Principal Payment (A-B) Carrying Value (Prior CV-Principal paid) 1 6/30/2014 2 12/31/2014 3 6/30/2015 4 12/31/2015 5 6/30/2016 6 12/31/2016 Sheetl O Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts