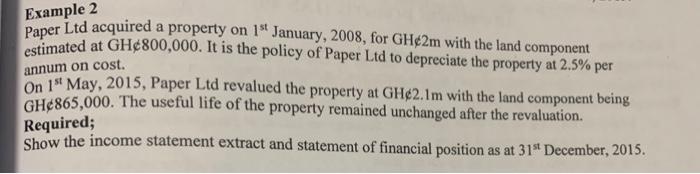

Question: Example 2 annum on cost. Paper Ltd acquired a property on 15 January, 2008, for GH2m with the land component estimated at GH800,000. It is

Example 2 annum on cost. Paper Ltd acquired a property on 15 January, 2008, for GH2m with the land component estimated at GH800,000. It is the policy of Paper Ltd to depreciate the property at 2,5% per On 1" May, 2015, Paper Ltd revalued the property at GH2.1m with the land component being GH865,000. The useful life of the property remained unchanged after the revaluation. Show the income statement extract and statement of financial position as at 31 December, 2015. Required

Step by Step Solution

There are 3 Steps involved in it

To solve this question lets follow these steps Step 1 Initial Calculation of Depreciation Acquisitio... View full answer

Get step-by-step solutions from verified subject matter experts