Question: Example 2: Bond Equivalent Yield Figure on previous slide shows a T-bill that expires May 30, 2019. It has 44 days to maturity. The ask

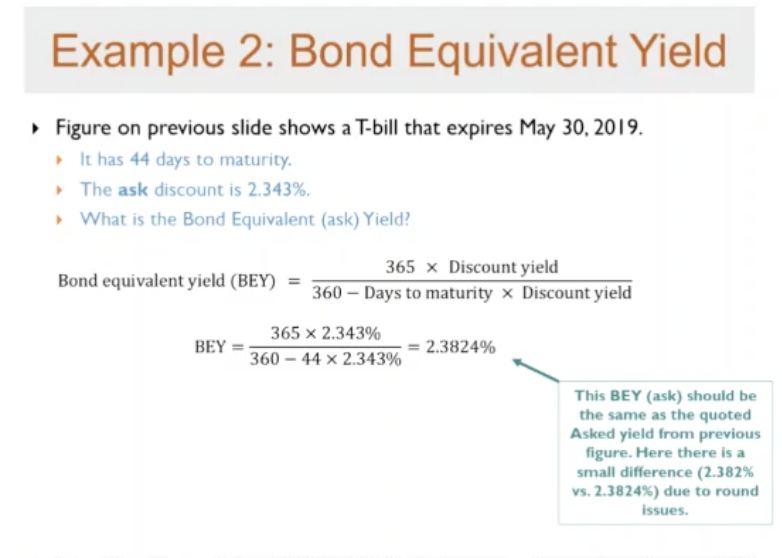

Example 2: Bond Equivalent Yield Figure on previous slide shows a T-bill that expires May 30, 2019. It has 44 days to maturity. The ask discount is 2.343%. What is the Bond Equivalent (ask) Yield? 365 Discount yield Bond equivalent yield (BEY) = 360 - Days to maturity x Discount yield 365 x 2.343% BEY 2.3824% 360 - 44 x 2.343% This BEY (ask) should be the same as the quoted Asked yield from previous figure. Here there is a small difference (2.382% vs. 2.3824%) due to round issues. Using the same Treasury bill in the example, what is the bid bond equivalent yield? 2.393% 2.382% 2.374% 2.369% Example 2: Bond Equivalent Yield Figure on previous slide shows a T-bill that expires May 30, 2019. It has 44 days to maturity. The ask discount is 2.343%. What is the Bond Equivalent (ask) Yield? 365 Discount yield Bond equivalent yield (BEY) = 360 - Days to maturity x Discount yield 365 x 2.343% BEY 2.3824% 360 - 44 x 2.343% This BEY (ask) should be the same as the quoted Asked yield from previous figure. Here there is a small difference (2.382% vs. 2.3824%) due to round issues. Using the same Treasury bill in the example, what is the bid bond equivalent yield? 2.393% 2.382% 2.374% 2.369%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts