Question: example 2. tost are expected to be $1.08, but could range from $.88 to $1.35. The contract requires the purchase of a $350,000 machine and

example 2.

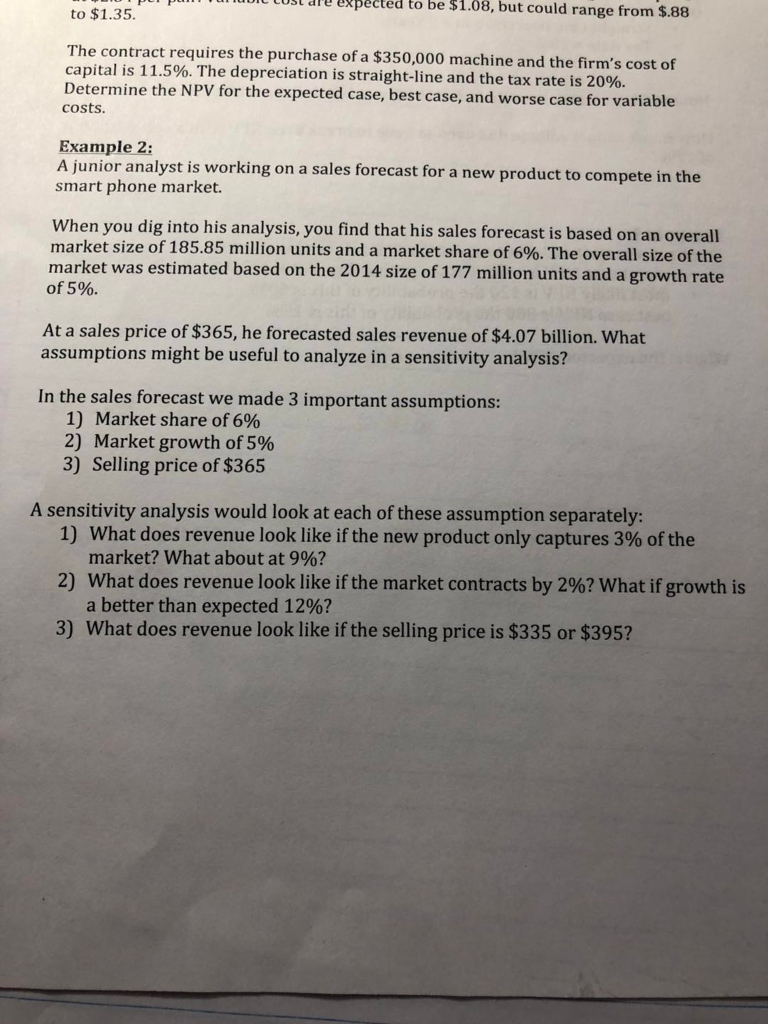

tost are expected to be $1.08, but could range from $.88 to $1.35. The contract requires the purchase of a $350,000 machine and the firm's cost of capital is 11.5%. The depreciation is straight-line and the tax rate is 20%. Determine the NPV for the expected case, best case, and worse case for variable costs. Example 2 A junior analyst is working on a sales forecast for a new product to compete in the smart phone market. When you dig into his analysis, you find that his sales forecast is based on an overall market size of 185.85 million units and a market share of 6%. The overall size of the market was estimated based on the 2014 size of 177 million units and a growth rate of 5%. At a sales price of $365, he forecasted sales revenue of $4.07 billion. What assumptions might be useful to analyze in a sensitivity analysis? In the sales forecast we made 3 important assumptions: 1) Market share of 6% 2) Market growth of 5% 3) Selling price of $365 A sensitivity analysis would look at each of these assumption separately What does revenue look like if the new product only captures 3% of the market? What about at 996? 1) 2) what does revenue look like if the market contracts by 2%? what if growth is 3) a better than expected 12%? What does revenue look like if the selling price is $335 or $395

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts