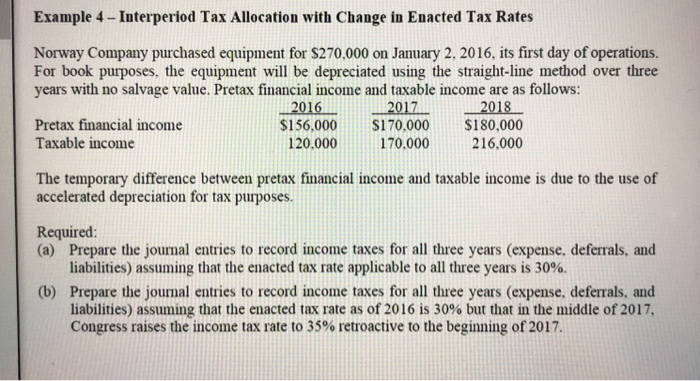

Question: Example 4 Interperiod Tax Allocation with Change in Enacted Tax Rates Norway Company purchased equipment for $270.000 on January 2. 2016, its first day of

Example 4 Interperiod Tax Allocation with Change in Enacted Tax Rates Norway Company purchased equipment for $270.000 on January 2. 2016, its first day of operations. For book purposes, the equipment will be depreciated using the straight-line method over three years with no salvage value. Pretax financial income and taxable income are as follows: 20162017L 2018 $156,000S170.000 $180,000 Pretax financial income Taxable income 20,000170,000 216,000 The temporary difference between pretax financial income and taxable income is due to the use of accelerated depreciation for tax purposes. Required: (a) Prepare the jounal entries to record income taxes for all three years (expense. deferrals, and liabilities) assuming that the enacted tax rate applicable to all three years is 30%. (b) Prepare the jounal entries to record income taxes for all three years (expense, deferrals, and liabilities) assuming that the enacted tax rate as of 2016 is 30% but that in the middle of 2017, Congress raises the income tax rate to 35% retroactive to the beginning of 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts