Question: Example 6.2: Please show each step on how to solve this using Excel 12. In Example 6.2, the fixed costs are split $4 million for

Example 6.2:

Please show each step on how to solve this using Excel

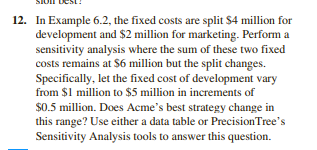

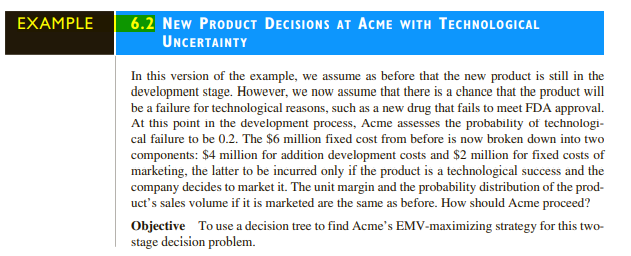

12. In Example 6.2, the fixed costs are split $4 million for development and $2 million for marketing. Perform a sensitivity analysis where the sum of these two fixed costs remains at $6 million but the split changes. Specifically, let the fixed cost of development vary from $1 million to $5 million in increments of $0.5 million. Does Acme's best strategy change in this range? Use either a data table or Precision Tree's Sensitivity Analysis tools to answer this question. EXAMPLE 6.2 NEW PRODUCT DECISIONS AT ACME WITH TECHNOLOGICAL UNCERTAINTY In this version of the example, we assume as before that the new product is still in the development stage. However, we now assume that there is a chance that the product will be a failure for technological reasons, such as a new drug that fails to meet FDA approval. At this point in the development process, Acme assesses the probability of technologi- cal failure to be 0.2. The $6 million fixed cost from before is now broken down into two components: $4 million for addition development costs and $2 million for fixed costs of marketing, the latter to be incurred only if the product is a technological success and the company decides to market it. The unit margin and the probability distribution of the prod- uct's sales volume if it is marketed are the same as before. How should Acme proceed? Objective To use a decision tree to find Acme's EMV-maximizing strategy for this two- stage decision problem 12. In Example 6.2, the fixed costs are split $4 million for development and $2 million for marketing. Perform a sensitivity analysis where the sum of these two fixed costs remains at $6 million but the split changes. Specifically, let the fixed cost of development vary from $1 million to $5 million in increments of $0.5 million. Does Acme's best strategy change in this range? Use either a data table or Precision Tree's Sensitivity Analysis tools to answer this question. EXAMPLE 6.2 NEW PRODUCT DECISIONS AT ACME WITH TECHNOLOGICAL UNCERTAINTY In this version of the example, we assume as before that the new product is still in the development stage. However, we now assume that there is a chance that the product will be a failure for technological reasons, such as a new drug that fails to meet FDA approval. At this point in the development process, Acme assesses the probability of technologi- cal failure to be 0.2. The $6 million fixed cost from before is now broken down into two components: $4 million for addition development costs and $2 million for fixed costs of marketing, the latter to be incurred only if the product is a technological success and the company decides to market it. The unit margin and the probability distribution of the prod- uct's sales volume if it is marketed are the same as before. How should Acme proceed? Objective To use a decision tree to find Acme's EMV-maximizing strategy for this two- stage decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts