Question: EXAMPLE 7 - 7 Comparison of Depreciation Methods The La Salle Bus Company has decided to purchase a new bus for $ 8 5 ,

EXAMPLE

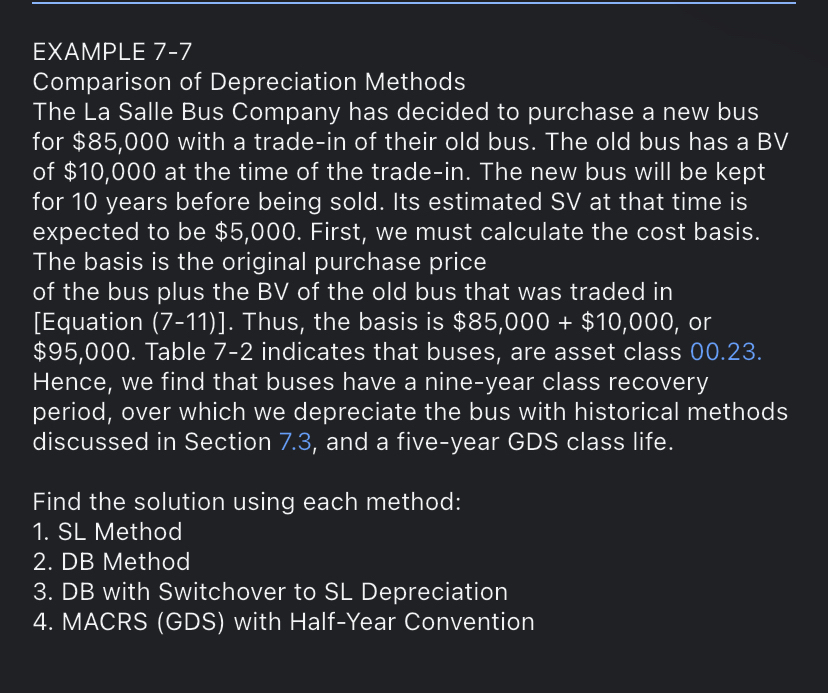

Comparison of Depreciation Methods The La Salle Bus Company has decided to purchase a new bus for $ with a tradein of their old bus. The old bus has a BV of $ at the time of the tradein The new bus will be kept for years before being sold. Its estimated SV at that time is expected to be $ First, we must calculate the cost basis. The basis is the original purchase price of the bus plus the BV of the old bus that was traded in Equation Thus, the basis is $ $ or $ Table indicates that buses, are asset class Hence, we find that buses have a nineyear class recovery period, over which we depreciate the bus with historical methods discussed in Section and a fiveyear GDS class life.

Find the solution using each method:

SL Method

DB Method

DB with Switchover to SL Depreciation

MACRS GDS with HalfYear Convention

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock