Question: Example Consider a five-year endowment insurance, with gross annual premiums and annual expenses paid at the beginning of each year and benefits paid at the

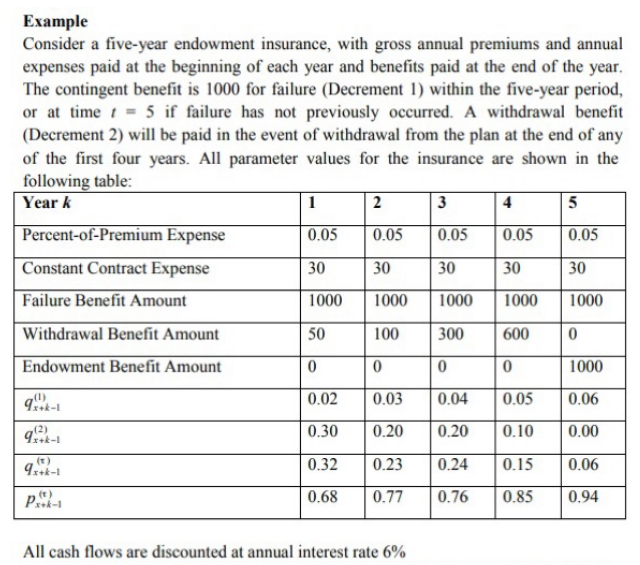

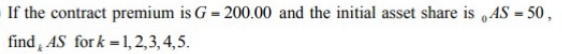

Example Consider a five-year endowment insurance, with gross annual premiums and annual expenses paid at the beginning of each year and benefits paid at the end of the year. The contingent benefit is 1000 for failure (Decrement 1) within the five-year period, or at time 1 = 5 if failure has not previously occurred. A withdrawal benefit (Decrement 2) will be paid in the event of withdrawal from the plan at the end of any of the first four years. All parameter values for the insurance are shown in the following table: Year k 1 2 3 4 5 Percent-of-Premium Expense 0.05 0.05 0.05 0.05 0.05 Constant Contract Expense 30 30 30 30 30 Failure Benefit Amount 1000 1000 1000 1000 1000 Withdrawal Benefit Amount 50 100 300 600 0 Endowment Benefit Amount 0 0 0 0 1000 q (1) 0.02 0.03 0.04 0.05 0.06 (2) 0.30 0.20 0.20 0.10 0.00 9x k-1 0.32 0.23 0.24 0.15 0.06 it) Park- 0.68 0.77 0.76 0.85 0.94 All cash flows are discounted at annual interest rate 6% If the contract premium is G = 200.00 and the initial asset share is AS = 50, find, AS for k=1,2,3,4,5. Example Consider a five-year endowment insurance, with gross annual premiums and annual expenses paid at the beginning of each year and benefits paid at the end of the year. The contingent benefit is 1000 for failure (Decrement 1) within the five-year period, or at time 1 = 5 if failure has not previously occurred. A withdrawal benefit (Decrement 2) will be paid in the event of withdrawal from the plan at the end of any of the first four years. All parameter values for the insurance are shown in the following table: Year k 1 2 3 4 5 Percent-of-Premium Expense 0.05 0.05 0.05 0.05 0.05 Constant Contract Expense 30 30 30 30 30 Failure Benefit Amount 1000 1000 1000 1000 1000 Withdrawal Benefit Amount 50 100 300 600 0 Endowment Benefit Amount 0 0 0 0 1000 q (1) 0.02 0.03 0.04 0.05 0.06 (2) 0.30 0.20 0.20 0.10 0.00 9x k-1 0.32 0.23 0.24 0.15 0.06 it) Park- 0.68 0.77 0.76 0.85 0.94 All cash flows are discounted at annual interest rate 6% If the contract premium is G = 200.00 and the initial asset share is AS = 50, find, AS for k=1,2,3,4,5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts