Question: Example No . 1 4 XYZ Manufacturing is considering replacing a broken metal cutting machine. Several options have been proposed. Option 1 : The broken

Example No

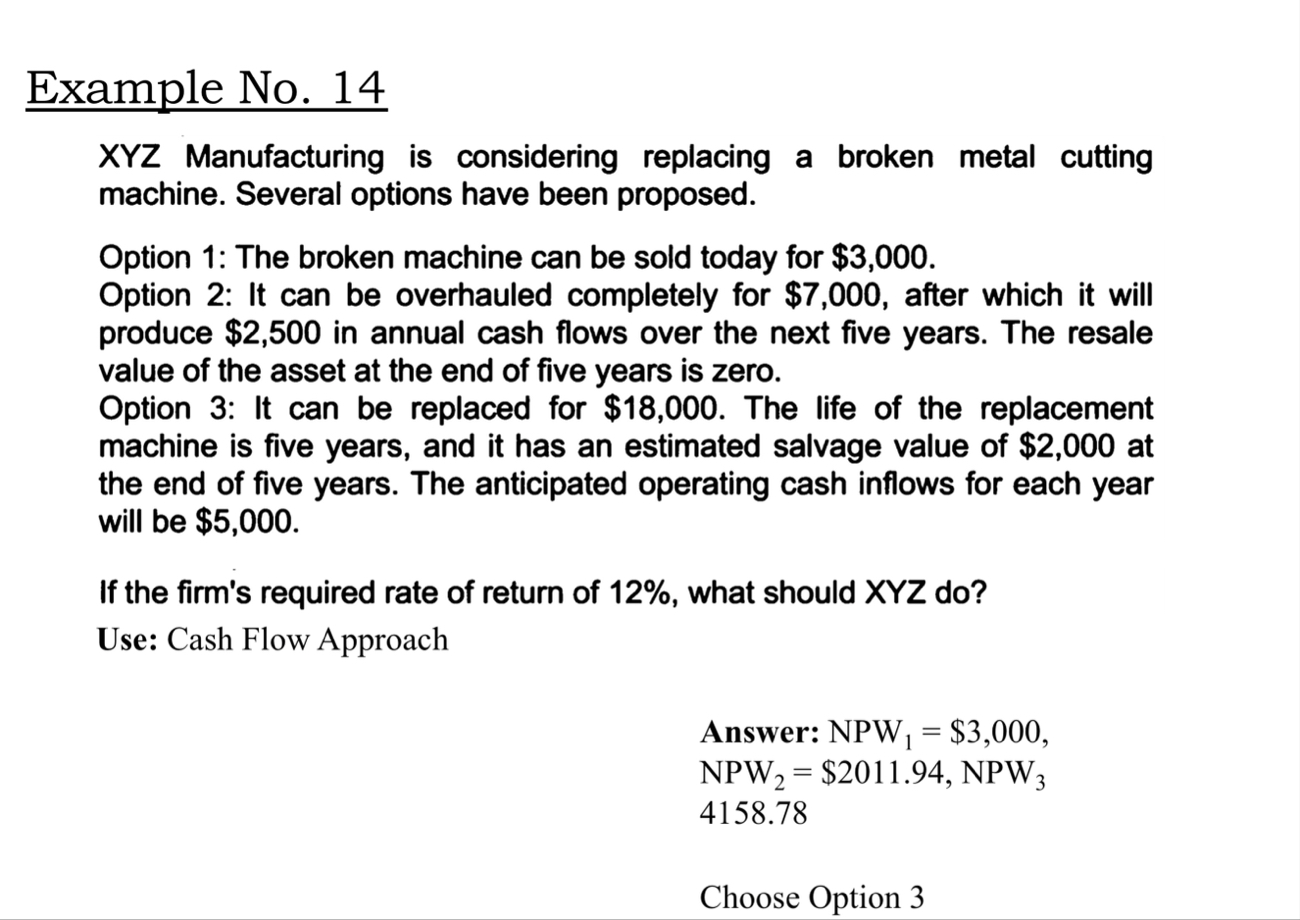

XYZ Manufacturing is considering replacing a broken metal cutting machine. Several options have been proposed.

Option : The broken machine can be sold today for $

Option : It can be overhauled completely for $ after which it will produce $ in annual cash flows over the next five years. The resale value of the asset at the end of five years is zero.

Option : It can be replaced for $ The life of the replacement machine is five years, and it has an estimated salvage value of $ at the end of five years. The anticipated operating cash inflows for each year will be $

If the firm's required rate of return of what should do

Use: Cash Flow Approach

Answer: $

$

Choose Option

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock