Question: Example: Sharda Company is considering two different processes to make its product-process 1 and process 2. Process 1 requires manufacturing subcomponents of the product in-house.

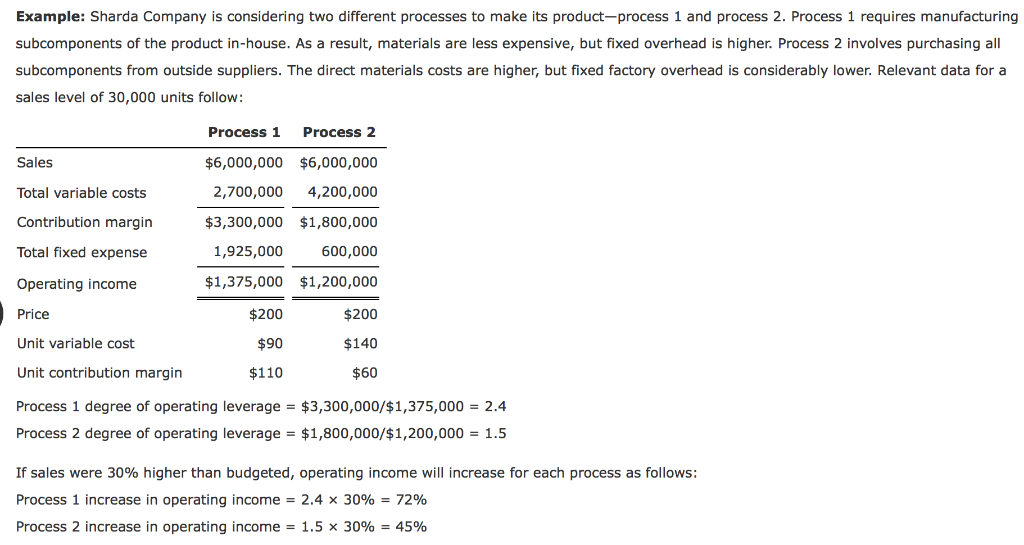

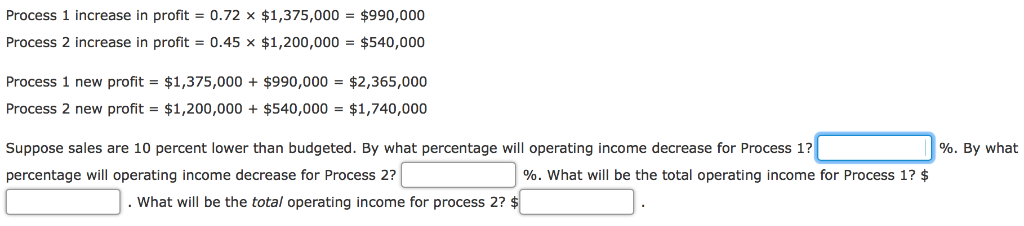

Example: Sharda Company is considering two different processes to make its product-process 1 and process 2. Process 1 requires manufacturing subcomponents of the product in-house. As a result, materials are less expensive, but fixed overhead is higher. Process 2 involves purchasing all subcomponents from outside suppliers. The direct materials costs are higher, but fixed factory overhead is considerably lower. Relevant data for a sales level of 30,000 units follow Sales Total variable costs Contribution margin Total fixed expense Operating income Price Unit variable cost Unit contribution margin Process 1 degree of operating leverage $3,300,000/$1,375,000 2.4 Process 2 degree of operating leverage $1,800,000/$1,200,000 1.5 If sales were 30% higher than budgeted, operating income will increase for each process as follows: Process 1 increase in operating income-2.4 x 30%-72% Process 2 increase in operating income-1.5 30%-45% Process 1 Process 2 $6,000,000 $6,000,000 2,700,000 4,200,000 $3,300,000 $1,800,000 600,000 $1,375,000 $1,200,000 $200 $140 $60 1,925,000 $200 $90 $110 Process 1 increase in profit 0.72 x $1,375,000-$990,000 Process 2 increase in profit 0.45 x $1,200,000-$540,000 Process 1 new profit-$1,375,000+$990,000-$2,365,000 Process 2 new profit-$1,200,000+$540,000-$1,740,000 Suppose sales are 10 percent lower than budgeted. By what percentage will operating income decrease for Process 1? percentage will operating income decrease for Process 2? %. By what 1 %, what will be the total operating income for Process 1? $ What will be the total operating income for process 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts