Question: Example. The table reports book values for Corp X, incorporated in the US. The company has paid $300.000 for interest on debt in the FY,

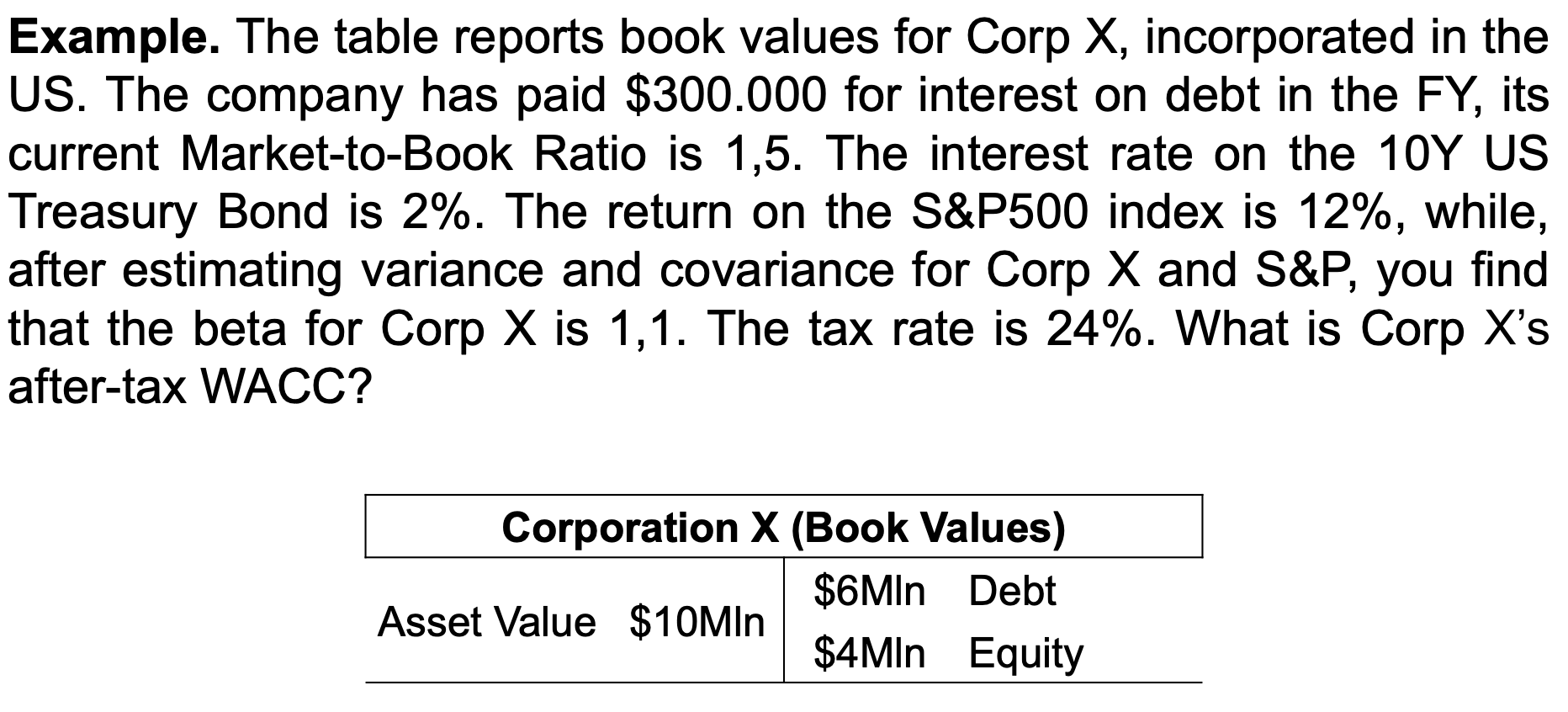

Example. The table reports book values for Corp X, incorporated in the US. The company has paid $300.000 for interest on debt in the FY, its current Market-to-Book Ratio is 1,5 . The interest rate on the 10Y US Treasury Bond is 2%. The return on the S\&P500 index is 12%, while, after estimating variance and covariance for Corp X and S\&P, you find that the beta for Corp X is 1,1 . The tax rate is 24%. What is Corp X's after-tax WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts