Question: The table reports book values for Corp X, incorporated in the US. The company has paid $300.000 for interest on debt in the FY,

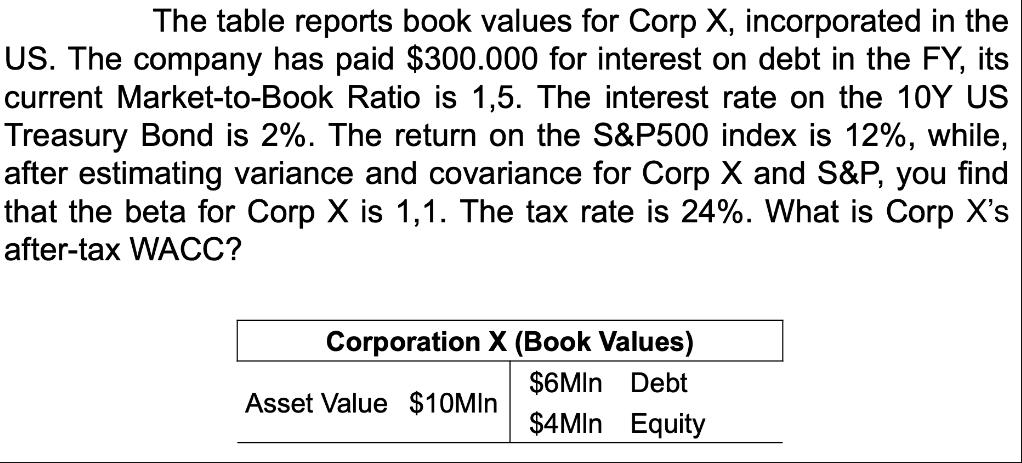

The table reports book values for Corp X, incorporated in the US. The company has paid $300.000 for interest on debt in the FY, its current Market-to-Book Ratio is 1,5. The interest rate on the 10Y US Treasury Bond is 2%. The return on the S&P500 index is 12%, while, after estimating variance and covariance for Corp X and S&P, you find that the beta for Corp X is 1,1. The tax rate is 24%. What is Corp X's after-tax WACC? Corporation X (Book Values) $6MIn Debt $4MIn Equity Asset Value $10Mln

Step by Step Solution

3.48 Rating (148 Votes )

There are 3 Steps involved in it

To calculate the aftertax Weighted Average Cost of Capital WACC for Corporation X we need to conside... View full answer

Get step-by-step solutions from verified subject matter experts