Question: Excel Activity: Bond Valuation Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner

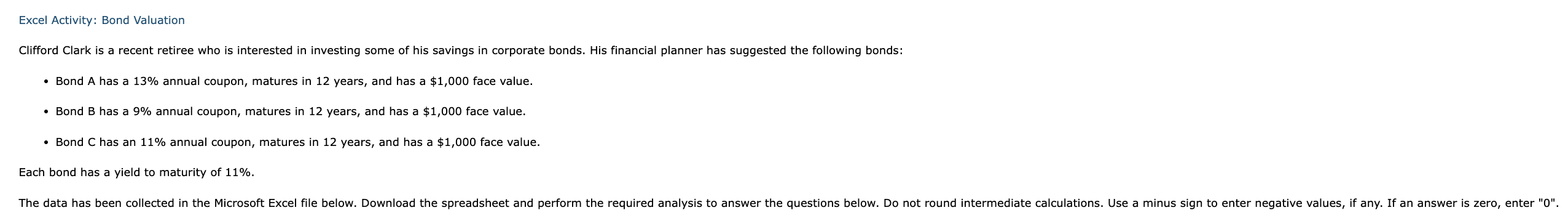

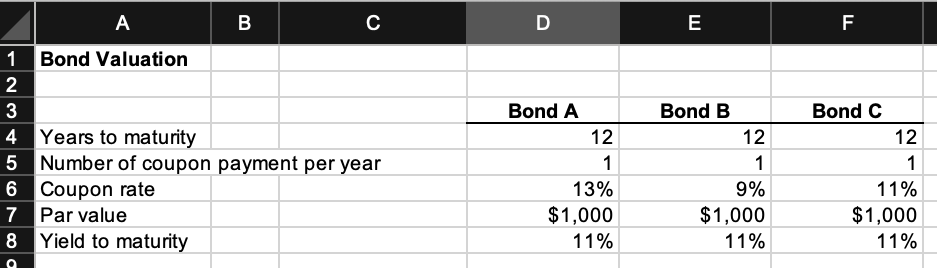

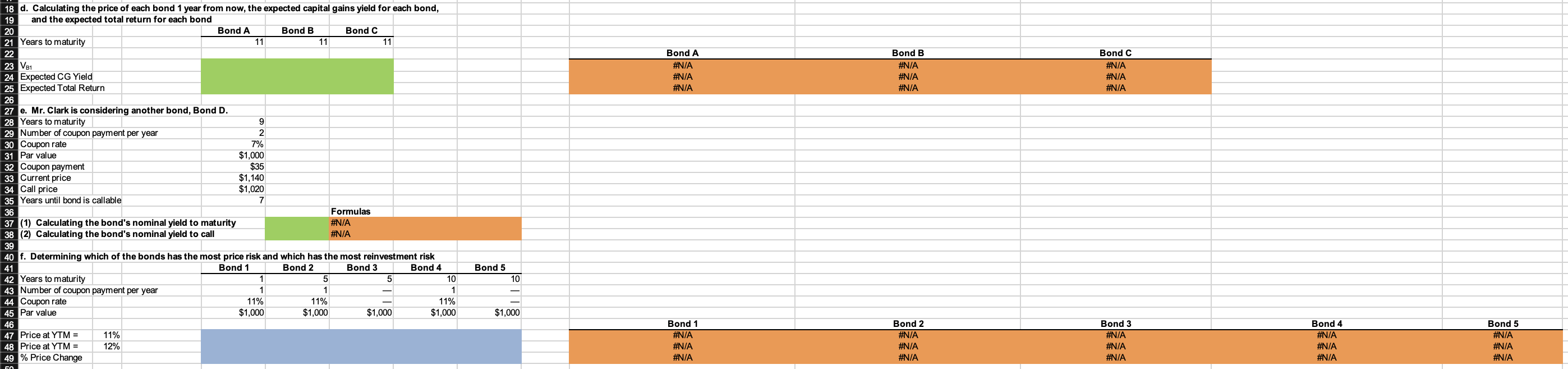

Excel Activity: Bond Valuation Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner has suggested the following bonds: - Bond A has a 13% annual coupon, matures in 12 years, and has a $1,000 face value. - Bond B has a 9% annual coupon, matures in 12 years, and has a $1,000 face value. - Bond C has an 11% annual coupon, matures in 12 years, and has a $1,000 face value. Each bond has a yield to maturity of 11%. \begin{tabular}{|l|l|l|l|r|r|} \hline & \multicolumn{1}{|c|}{A} & B & C & E & \multicolumn{1}{c|}{ F } \\ \hline 1 & Bond Valuation & & & & \\ \hline 2 & & & & \\ \hline 3 & & & Bond A & \multicolumn{1}{|c|}{ Bond B } & Bond C \\ \hline 4 & Years to maturity & 12 & 12 & 12 \\ \hline 5 & Number of coupon payment per year & 1 & 1 & 1 \\ \hline 6 & Coupon rate & 13% & 9% & 11% \\ \hline 7 & Par value & & $1,000 & $1,000 & $1,000 \\ \hline 8 & Yield to maturity & 11% & 11% & 11% \\ \hline \end{tabular} d. Calculating the price of each bond 1 year from now, the expected capital gains yield for each bond, Years to maturity VB1 Expected Total Return e. Mr. Clark is considering another bond, Bond D. d. If the vield to maturity for each bond remains at 11%, witat will be the price of each bond 1 year from now? Round your answers to the nearest cent. Price (Bond A): $ Price (Bond 83:$ Price (Bond C ) $ What is the expected capital geins yield for each bond? What is the expected total return for each bond? Round your answers to two decimal places. 1. What is the bond's naminal yieid ta maturity? Round your answer to two decimal places. 2. What is the bond's naminal yieid to call? Round your answer to two decimal places. 3. If Mr. Clark were to purchase this bond, would he he more likely to recelve the yield to maturity or yield to call? Explain your answer. Because the YTM is the YTC, Mr. Clark expect the bond to be called. Consequently, he would earn f. Explain briefly the difference between price risk and reinveatment risk. This risk of a decline in bond values due to an increase in interest rates is called . The risk of an income decline due to a drop in interest rates is called Which of the following bonds has the most price risk? Which has the most reinvestment risk? - A 1-year band with an 11% amnual coupon - A 5-year bond with an 11% annual coupon - A 5-year bond with a zero coupon - A 10 -ycar bond with an 118 annual coupan - A 10-year hond with a zern caupon I has the mat price riak. Jhas the moat reimvestment risk. Excel Activity: Bond Valuation Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner has suggested the following bonds: - Bond A has a 13% annual coupon, matures in 12 years, and has a $1,000 face value. - Bond B has a 9% annual coupon, matures in 12 years, and has a $1,000 face value. - Bond C has an 11% annual coupon, matures in 12 years, and has a $1,000 face value. Each bond has a yield to maturity of 11%. \begin{tabular}{|l|l|l|l|r|r|} \hline & \multicolumn{1}{|c|}{A} & B & C & E & \multicolumn{1}{c|}{ F } \\ \hline 1 & Bond Valuation & & & & \\ \hline 2 & & & & \\ \hline 3 & & & Bond A & \multicolumn{1}{|c|}{ Bond B } & Bond C \\ \hline 4 & Years to maturity & 12 & 12 & 12 \\ \hline 5 & Number of coupon payment per year & 1 & 1 & 1 \\ \hline 6 & Coupon rate & 13% & 9% & 11% \\ \hline 7 & Par value & & $1,000 & $1,000 & $1,000 \\ \hline 8 & Yield to maturity & 11% & 11% & 11% \\ \hline \end{tabular} d. Calculating the price of each bond 1 year from now, the expected capital gains yield for each bond, Years to maturity VB1 Expected Total Return e. Mr. Clark is considering another bond, Bond D. d. If the vield to maturity for each bond remains at 11%, witat will be the price of each bond 1 year from now? Round your answers to the nearest cent. Price (Bond A): $ Price (Bond 83:$ Price (Bond C ) $ What is the expected capital geins yield for each bond? What is the expected total return for each bond? Round your answers to two decimal places. 1. What is the bond's naminal yieid ta maturity? Round your answer to two decimal places. 2. What is the bond's naminal yieid to call? Round your answer to two decimal places. 3. If Mr. Clark were to purchase this bond, would he he more likely to recelve the yield to maturity or yield to call? Explain your answer. Because the YTM is the YTC, Mr. Clark expect the bond to be called. Consequently, he would earn f. Explain briefly the difference between price risk and reinveatment risk. This risk of a decline in bond values due to an increase in interest rates is called . The risk of an income decline due to a drop in interest rates is called Which of the following bonds has the most price risk? Which has the most reinvestment risk? - A 1-year band with an 11% amnual coupon - A 5-year bond with an 11% annual coupon - A 5-year bond with a zero coupon - A 10 -ycar bond with an 118 annual coupan - A 10-year hond with a zern caupon I has the mat price riak. Jhas the moat reimvestment risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts