Question: Excel Assignment Spring 2021 (2) Home Data Review View Insert C Copy Page Layout Formulas Caibri (Body) - 11 A- A Wrap Text General Peste

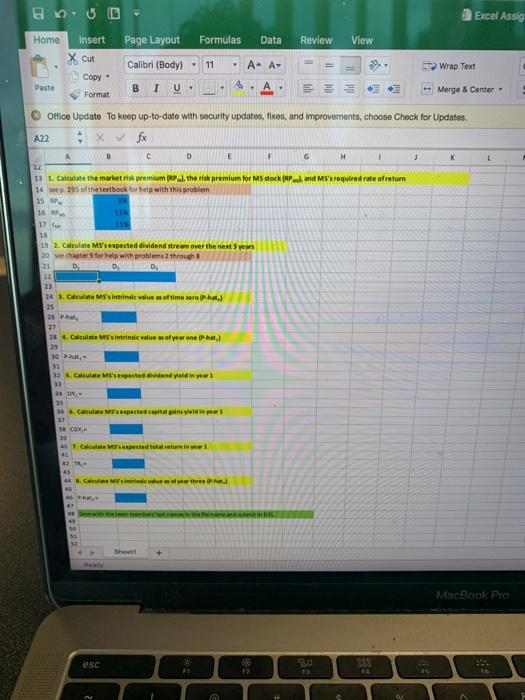

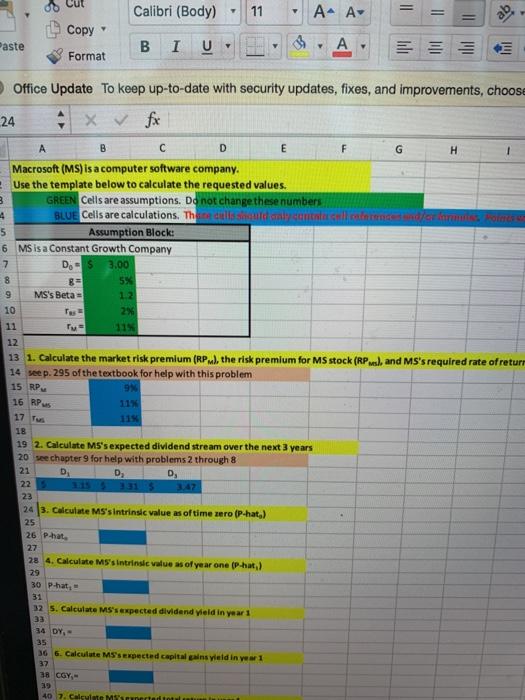

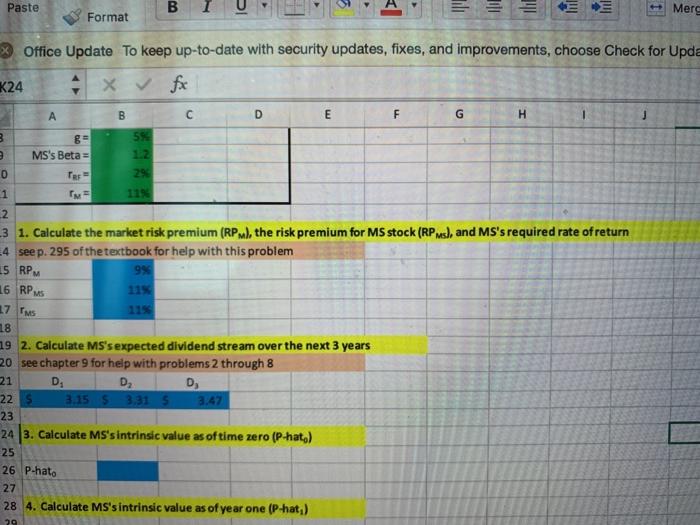

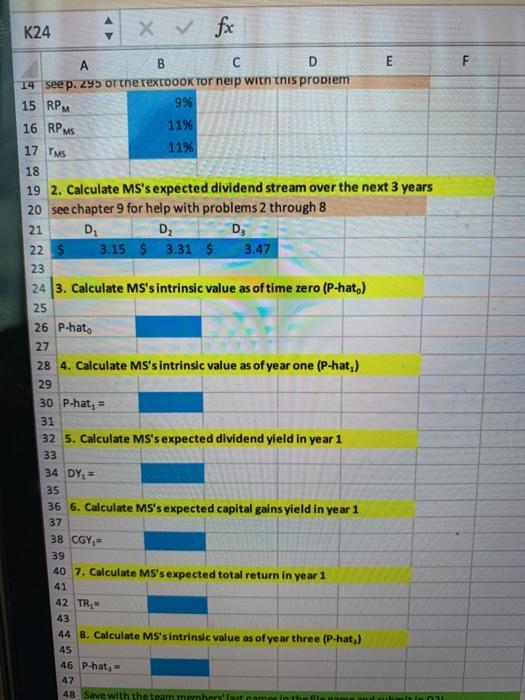

Excel Assignment Spring 2021 (2) Home Data Review View Insert C Copy Page Layout Formulas Caibri (Body) - 11 A- A Wrap Text General Peste Merge Center S. %) Office Update To keep up to date with security updates, fires, and improvements, choose Check for Updates A22 3 E F H M N 0 1 Macron 2. U how there was Cells are calcul Aceh Cowhom w Le 13 L.Cat the marrin p...them for MSP Surefretum 15 13 11. Ce der the next years 23 14 . We aini 3 3 10 OY MacBook Pro OSC 80 BE 94 ES Excel Assig Home Review View Insert of out Copy Page Layout Formulas Data Calibri (Body). 11 AAA- BIU - Wrap Text Paste Format Morge & Center Office Update To keep up to date with security updates, fixes, and improvements, choose Check for Updates A22 fx B C D E F G H 1 J 12 13. Calculate the market rik premium Pl. the risk premium for MS stocks and MS's required rate of return 14 p. 295 of the textbook for help with this problem 15 W 16 17 tu 18 15 2. Calcule MS's expected dividend stream over the next 3 years 20 chapter for with problems through 21 D. D. 22 23 24 s'intrine values of time aroha 25 14. Calculate M'sintrine value of year aneh, 30 hat, 31 25. Calculate Secondandi ew1 31 34 OY 15 36 CMS respected capital inedinew1 23 30 CY 10 CM's expected to return in 1 44 CMS three phal 46 - 51 MacBook Pro esc 20 bo Calibri (Body) 7 11 7 A- A+ Copy Paste B 1 A === Format Office Update To keep up-to-date with security updates, fixes, and improvements, choose 24 x & fx G H 1 B D E F Macrosoft (MS) is a computer software company. Use the template below to calculate the requested values. 3 GREEN Cells are assumptions. Do not change these numbers 4 BLUE Cells are calculations. These della caly contact 5 Assumption Block: 6 MS is a Constant Growth Company 7 DS 3.00 R= 5% 9 NS's Beta = 12 10 2% Tv 11% 12 8 17 Tus 13 1. Calculate the market risk premium (RPM), the risk premium for MS stock (RP). and MS's required rate of return 14 sep. 295 of the textbook for help with this problem 15 RPG 9% 16 RPS 11% 18 19 2. Calculate MS's expected dividend stream over the next 3 years 20 see chapter 9 for help with problems 2 through & 21 D D D 22 23 243. Calculate MS'sintrinsic value as of time zero (P-hat.) 25 20 Pha 27 28 4. Calculate MS's intrinsic value as of year one (P-hat) 29 30 Pihat, 31 32 5. Calculate MS's expected dividend yield in year 1 33 34 DY, 35 36 6. Calculate MS's expected capital gains yled in year 1 37 38 CGY,- 39 40 7. Calculate Minerte Paste B U TE THE IT Ini + Merg Format 93 Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Upda K24 x fx B C D E F G H J 3 54 MS's Beta D Tes 29 1 11% 2 3 1. Calculate the market risk premium (RPM), the risk premium for MS stock (RPM), and MS's required rate of return 4 see p. 295 of the textbook for help with this problem 15 RPM 9 115 16 RPM 17 IMS 18 19 2. Calculate MS's expected dividend stream over the next 3 years 20 see chapter 9 for help with problems 2 through 8 21 D D 22 3.15 5 3,315 3.47 23 24 3. Calculate MS's intrinsic value as of time zero (P-hat) 25 26 p-hat. 27 28 4. Calculate MS's intrinsic value as of year one (P-hat) 29 K24 fox E F A B 14 see p. 295 or the textDOOK Torneip with this proprem 9% 11% 11% 15 RPM 16 RPMS 17 rus 18 19 2. Calculate MS's expected dividend stream over the next 3 years 20 see chapter 9 for help with problems 2 through 8 21 D D2 D; 22 3.15 $ 3.31 $ 3.47 23 24 3. Calculate MS'sintrinsic value as oftime zero (P-hat) 25 26 P-hat. 27 28 4. Calculate MS's intrinsic value as of year one (P-hat) 29 30 P-hat, 31 32 5. Calculate MS's expected dividend yield in year 1 33 34 DY, 35 36 6. Calculate MS's expected capital gains yield in year 1 37 38 CGY,- 39 40 7. Calculate MS's expected total return in year 1 41 42 TR 43 44 8. Calculate MS's intrinsic value as of year three (P-hat) 45 46 P-hat, - 47 48 Save with the team mem in ni

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts