Question: Excel file data: Please answer these 5 questions and show the details for me. Thank you !!!!!! 1 Month Coca Cola S&P500 2 31/1/2020 5.364%

Excel file data:

Please answer these 5 questions and show the details for me. Thank you !!!!!!

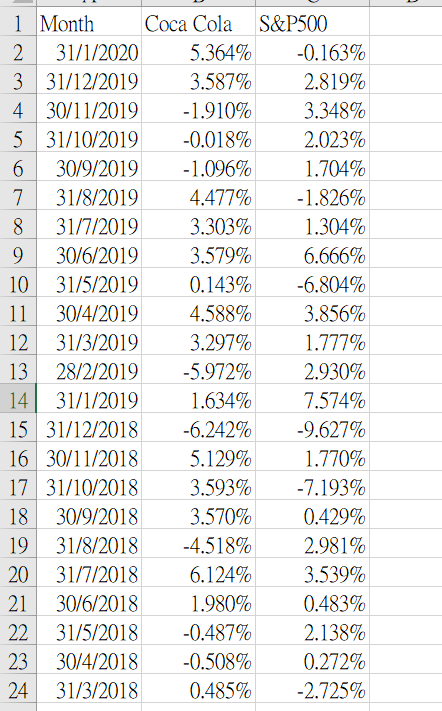

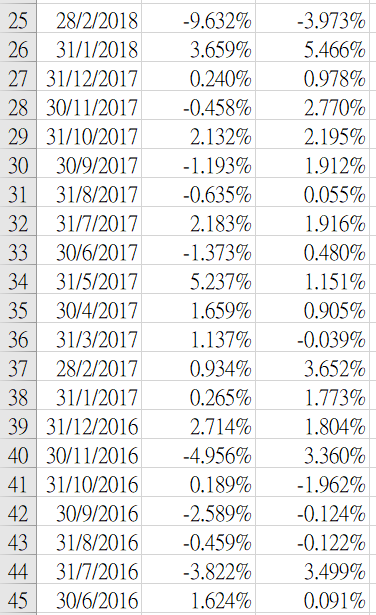

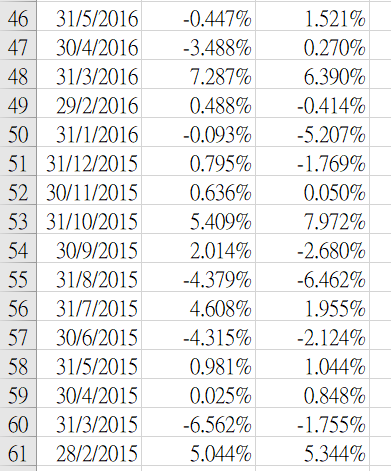

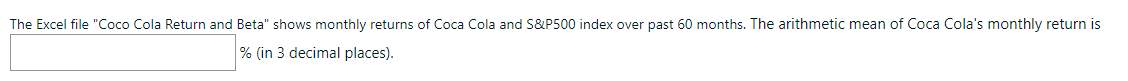

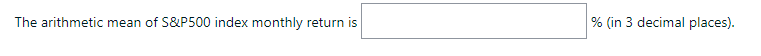

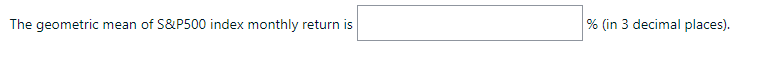

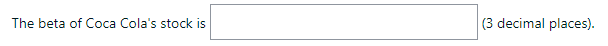

1 Month Coca Cola S&P500 2 31/1/2020 5.364% -0.163% 3 31/12/2019 3.587% 2.819% 4 30/11/2019 -1.910% 3.348% 5 31/10/2019 -0.018% 2.023% 6 30/9/2019 -1.096% 1.704% 7 31/8/2019 4.477% -1.826% 8 31/7/2019 3.303% 1.304% 9 30/6/2019 3.579% 6.666% 10 31/5/2019 0.143% -6.804% 11 30/4/2019 4.588% 3.856% 12 31/3/2019 3.297% 1.777% 13 28/2/2019 -5.972% 2.930% 14 31/1/2019 1.634% 7.574% 15 31/12/2018 -6.242% -9.627% 16 30/11/2018 5.129% 1.770% 17 31/10/2018 3.593% -7.193% 18 30/9/2018 3.570% 0.429% 19 31/8/2018 -4.518% 2.981% 20 31/7/2018 6.124% 3.539% 21 30/6/2018 1.980% 0.483% 22 31/5/2018 -0.487% 2.138% 23 30/4/2018 -0.508% 0.272% 24 31/3/2018 0.485% -2.725% 25 28/2/2018 26 31/1/2018 27 31/12/2017 28 30/11/2017 29 31/10/2017 30 30/9/2017 31 31/8/2017 32 31/7/2017 33 30/6/2017 34 31/5/2017 35 30/4/2017 36 31/3/2017 37 28/2/2017 38 31/1/2017 39 31/12/2016 40 30/11/2016 41 31/10/2016 42 30/9/2016 43 31/8/2016 44 31/7/2016 45 30/6/2016 -9.632% 3.659% 0.240% -0.458% 2.132% -1.193% -0.635% 2.183% -1.373% 5.237% 1.659% 1.137% 0.934% 0.265% 2.714% -4.956% 0.189% -2.589% -0.459% -3.822% 1.624% -3.973% 5.466% 0.978% 2.770% 2.195% 1.912% 0.055% 1.916% 0.480% 1.151% 0.905% -0.039% 3.652% 1.773% 1.804% 3.360% -1.962% -0.124% -0.122% 3.499% 0.091% 46 31/5/2016 47 30/4/2016 48 31/3/2016 49 29/2/2016 50 31/1/2016 51 31/12/2015 52 30/11/2015 53 31/10/2015 54 30/9/2015 55 31/8/2015 56 31/7/2015 57 30/6/2015 58 31/5/2015 59 30/4/2015 60 31/3/2015 61 28/2/2015 -0.447% -3.488% 7.287% 0.488% -0.093% 0.795% 0.636% 5.409% 2.014% -4.379% 4.608% -4.315% 0.981% 0.025% -6.562% 5.044% 1.521% 0.270% 6.390% -0.414% -5.207% -1.769% 0.050% 7.972% -2.680% -6.462% 1.955% -2.124% 1.044% 0.848% -1.755% 5.344% The Excel file "Coco Cola Return and Beta" shows monthly returns of Coca Cola and S&P500 index over past 60 months. The arithmetic mean of Coca Cola's monthly return is % in 3 decimal places). The arithmetic mean of S&P500 index monthly return is % in 3 decimal places). The geometric mean of Coca Cola's monthly return is % in 3 decimal places). The geometric mean of S&P500 index monthly return is % (in 3 decimal places). The beta of Coca Cola's stock is (3 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts