Question: Excel File Edit View Insert Format Tools Data Window Help AutoSave Bu $4 + BA 404 HW Chapter 12 Home Insert Draw Page Layout Formulas

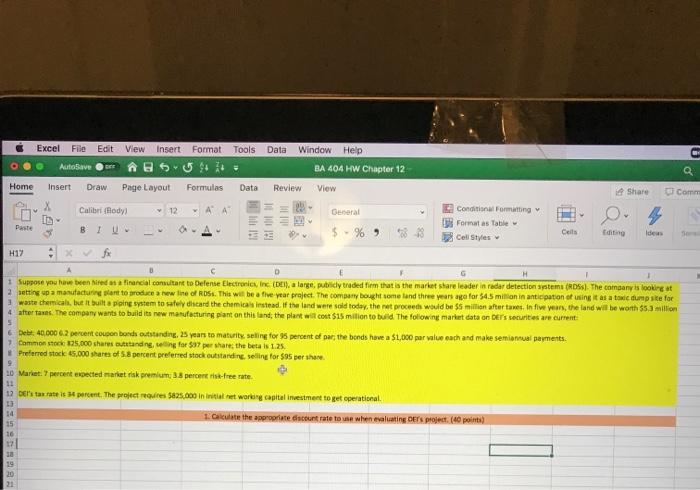

Excel File Edit View Insert Format Tools Data Window Help AutoSave Bu $4 + BA 404 HW Chapter 12 Home Insert Draw Page Layout Formulas Data Review View X Calibri (Body 12 A A General BIU $ 969 Review Share Com Conditional Formatting Formatas Table Cell Styles Ceils Editing Ideas H17 D E H 1 Suppose you have been hired as financial constant to Defense Electronics, Inc. (DI), a large publicly traded firm that is the market share leader in radar detection system (RDS). The company is looking at 2 setting up a manufacturing and to renew line of RDS. This will be a five-year project. The company bought some and three years ago for $4.5 million in anticipation of using it as a tactum site for 1 waste chemicals, but it built a piping system to safely discard the chemicals instead of the land were sold today, the rat proceeds would be $5 million after taxesIn five years, the land will be worth $5.3 million 4 after takes. The company wants to build its new manufacturing plant on this and the plant will cost $15 milion to build the following market data on DEF's securities are current 5 Debr. 40.000 percent coupon bond standing 25 years to maturity selling for 95 percent of par; the bonds have a $1,000 par value each and make semiannuai naments 7. Common stock 125.000 shares standing in for $37 per share the beta is 1.25. Preferred stock 45.000 shares of 5.8 percent preferred stock outstanding, veling for $95 per share 20 Market" percent expected market rak premium 3.8 percent is free rate 11 12 strate is 3 percent. The project requires S25.000 in real net worry capital inestment to pet operational 13 14 Gite the appropriate discount rate to use when alting Der's project (40 points) 15 10 17 9 19 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts