Question: this is the template Part 4: Fully amortized Variable rate mortgage 1. Assume that you know in advance (at the time of the mortgage initiation)

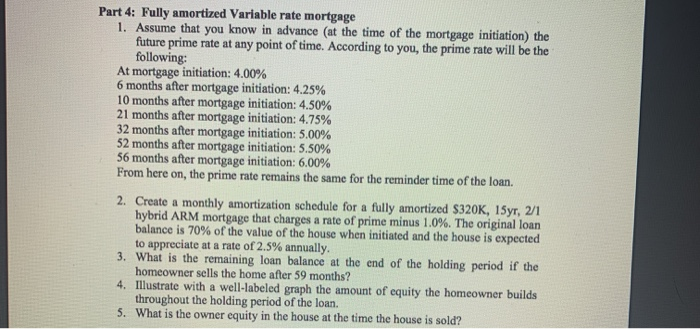

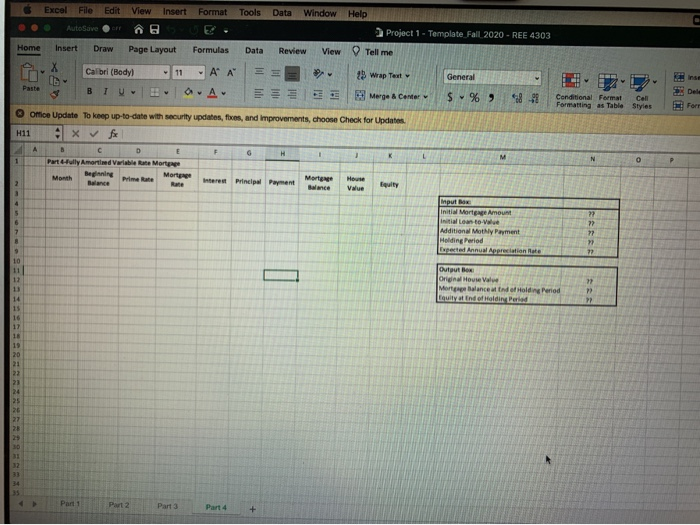

Part 4: Fully amortized Variable rate mortgage 1. Assume that you know in advance (at the time of the mortgage initiation) the future prime rate at any point of time. According to you, the prime rate will be the following: At mortgage initiation: 4.00% 6 months after mortgage initiation: 4.25% 10 months after mortgage initiation: 4.50% 21 months after mortgage initiation: 4.75% 32 months after mortgage initiation: 5.00% 52 months after mortgage initiation: 5.50% 56 months after mortgage initiation: 6.00% From here on, the prime rate remains the same for the reminder time of the loan. 2. Create a monthly amortization schedule for a fully amortized $320K, 15yr, 2/1 hybrid ARM mortgage that charges a rate of prime minus 1.0%. The original loan balance is 70% of the value of the house when initiated and the house is expected to appreciate at a rate of 2.5% annually. 3. What is the remaining loan balance at the end of the holding period if the homeowner sells the home after 59 months? 4. Illustrate with a well-labeled graph the amount of equity the homeowner builds throughout the holding period of the loan. 5. What is the owner equity in the house at the time the house is sold? Excel File Edit View Insert Format Tools Data Window Help AutoSave Project 1 - Template Fall 2020 - REE 4303 Home Insert Draw Page Layout Formulas Data Review View Tell me ins General $ % 9 DX Del 8-21 Conditional Format Cell Formatting as Table Styles Forr X Calibri (Bodyl 11 A A 29 Wrap Text LG Paste B TU a. A Merge & Center Omice Update To keep up-to-date with security updates, fxes, and improvements, choose Check for Updates H11 x x D E F G H K 1 Part Fully Amortid Variable Rate Mortgage Beginning Prime Rate Mart Month Mortene House Balance Principal Payment Balance Equity Value 1 M N o 4 5 Input Box Initi Mortgage Amount inal Loan to vie Additional Mothy Payment Holding Period Experted Annual Appreciation Rate 7 22 72 77 > ?? 9 10 11 Output Box Original House Valve Morte Balance and of Holding Period culty of End of Holding 12 14 16 17 18 19 20 21 22 23 24 25 26 27 30 34 Part 1 Part 2 Part 3 Part 4 + Part 4: Fully amortized Variable rate mortgage 1. Assume that you know in advance (at the time of the mortgage initiation) the future prime rate at any point of time. According to you, the prime rate will be the following: At mortgage initiation: 4.00% 6 months after mortgage initiation: 4.25% 10 months after mortgage initiation: 4.50% 21 months after mortgage initiation: 4.75% 32 months after mortgage initiation: 5.00% 52 months after mortgage initiation: 5.50% 56 months after mortgage initiation: 6.00% From here on, the prime rate remains the same for the reminder time of the loan. 2. Create a monthly amortization schedule for a fully amortized $320K, 15yr, 2/1 hybrid ARM mortgage that charges a rate of prime minus 1.0%. The original loan balance is 70% of the value of the house when initiated and the house is expected to appreciate at a rate of 2.5% annually. 3. What is the remaining loan balance at the end of the holding period if the homeowner sells the home after 59 months? 4. Illustrate with a well-labeled graph the amount of equity the homeowner builds throughout the holding period of the loan. 5. What is the owner equity in the house at the time the house is sold? Excel File Edit View Insert Format Tools Data Window Help AutoSave Project 1 - Template Fall 2020 - REE 4303 Home Insert Draw Page Layout Formulas Data Review View Tell me ins General $ % 9 DX Del 8-21 Conditional Format Cell Formatting as Table Styles Forr X Calibri (Bodyl 11 A A 29 Wrap Text LG Paste B TU a. A Merge & Center Omice Update To keep up-to-date with security updates, fxes, and improvements, choose Check for Updates H11 x x D E F G H K 1 Part Fully Amortid Variable Rate Mortgage Beginning Prime Rate Mart Month Mortene House Balance Principal Payment Balance Equity Value 1 M N o 4 5 Input Box Initi Mortgage Amount inal Loan to vie Additional Mothy Payment Holding Period Experted Annual Appreciation Rate 7 22 72 77 > ?? 9 10 11 Output Box Original House Valve Morte Balance and of Holding Period culty of End of Holding 12 14 16 17 18 19 20 21 22 23 24 25 26 27 30 34 Part 1 Part 2 Part 3 Part 4 +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts