Question: Excel File Edit View Insert Format Tools Data Window Help AutoSave OFF Last_First Shape Formato Home Insert Draw Page Layout Formulas Data Review View ~

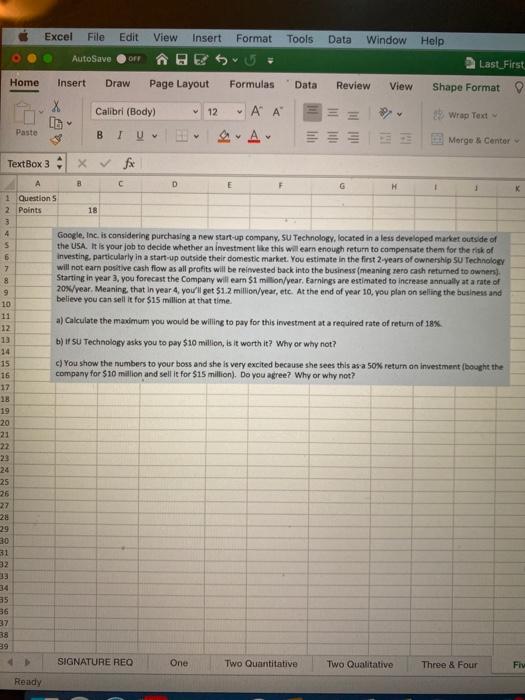

Excel File Edit View Insert Format Tools Data Window Help AutoSave OFF Last_First Shape Formato Home Insert Draw Page Layout Formulas Data Review View ~ Av Toll A K 7 8 Calibri (Body 12 A A Wrap Text Paste B U Morge Center TextBox 3 fx B D F G 1 1 Questions 2 Points 18 3 4 Google, Inc. is considering purchasing a new start-up company, SU Technology, located in a less developed market outside of 5 the USA. It is your job to decide whether an investment like this will earn enough return to compensate them for the risk of 6 Investing particularly in a start-up outside their domestic market. You estimate in the first 2 years of ownership Su Technology will not earn positive cash flow as all profits will be reinvested back into the business (meaning nero cash returned to owners). Starting in year 3, you forecast the Company will earn $1 million/year, Earnings are estimated to increase annually at a rate of 20%/year. Meaning that in year 4 you'll get $1.2 million/year, etc. At the end of year 10, you plan on selling the business and believe you can sell it for $15 million at that time 10 11 a) Calculate the maximum you would be willing to pay for this investment at a required rate of return of 18% 12 13 b) Su Technology asks you to pay $10 million, is it worth it? Why or why not? 14 15 C) You show the numbers to your boss and she is very excited because she sees this asa 50% return on investment bought the 16 company for $10 million and sell it for $15 million). Do you agree? Why or why not? 17 18 19 20 21 22 23 24 25 19 27 29 30 31 32 33 35 36 37 38 SIGNATURE REO One Two Quantitative Two Qualitative Three & Four FI Ready

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts