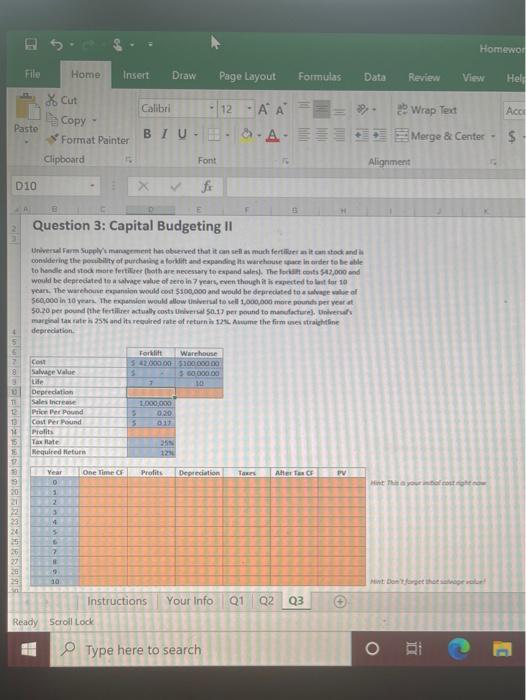

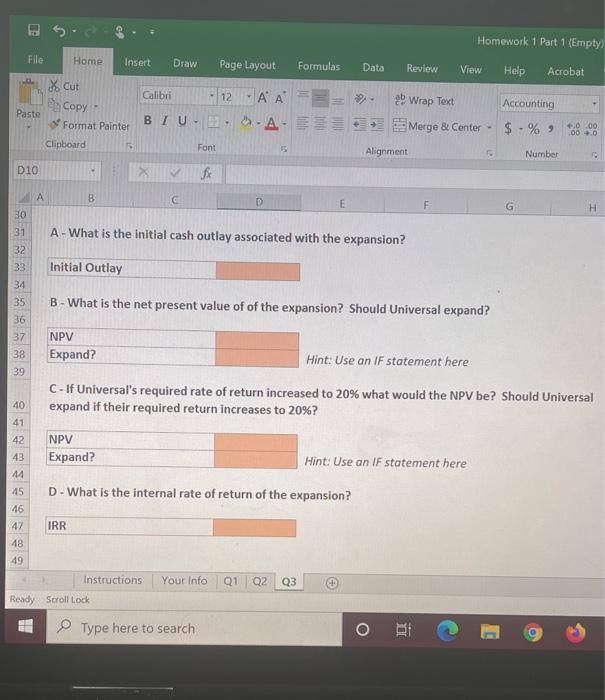

Question: EXCEL HELP PLEASE!! The Orange slots I need answers for MUST include the excel formulas/functions and not just the answers or i will receive no

Homewo File Home Insert Draw Page Layout Formulas Data Review View Hel Galibri 12 Aca & Cut Copy Paste Format Painter Clipboard -AA = A. 2 Wrap Ted Merge & Center BIU. Font Alignment D10 f fo B Question 3: Capital Budgeting II Universal Farm Supply management has beerved that it conseils much fertiti sto and considering the posibility of purchforlift and expanding to war rder to be able to handle and stock more fertilizer Thoth are necessary to expand sales. The cost $47,000 and would be deprecated to al value oferein 7 years, even though it is expected to for 10 years. The wareho pansion would cost $300,000 and would be deprecated to gevalle af $60,000 in 10 years. The expansion would allow to sell 1,000,000 more pounds per year at 50.20 per pound the fertile actually costs er $0.17 per pound to manufacture, Universal marginal tax rate and its required rate of return is. Aume the firm unes trichine depreciation 8 Forklift Warehouse 5200000 50000000 5 3000 DO 1 Cou Salvace Value Life Depreciation Sales increase Pri Per Pound Cost Per Pound Petits Taxe Required Return 1.000.000 0.20 3 5 13 14 15 25 12 Year One Time OF Profits Depreciation TO As of PV Wat is your into 21 1 2 3 4 5 20 2 9 1a Monet the Your Info 01 Q2 Q3 Instructions Ready Scroll lock Type here to search Homework 1 Part 1 (Empty) File Home Insert Draw Page Layout Formulas Data Review View Help Acrobat Calibri 12 X Cut Es Copy - Format Painter ab Wrap Text AA -A- Accounting Paste BIU- Merge & Center - $ % 4.000 000 Clipboard Font Alignment Number D10 f fe A G B C D E F H 30 31 A - What is the initial cash outlay associated with the expansion? 32 33 Initial Outlay 34 35 B - What is the net present value of of the expansion? Should Universal expand? 36 37 NPV 38 Expand? Hint: Use an IF statement here 39 C- If Universal's required rate of return increased to 20% what would the NPV be? Should Universal 40 expand if their required return increases to 20%? 41 42 NPV 43 Expand? Hint: Use an IF statement here 44 45 D- What is the internal rate of return of the expansion? 46 47 IRR 48 49 Instructions Your Info Q1 Q2 Q3 Ready Scroll Lock Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts