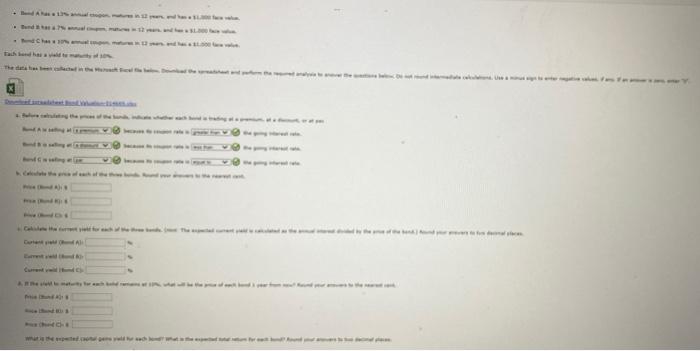

Question: Excel online structured activity bond valuation. SP RE N a a w F G 1 Bond Valuation 2 3 Bond A Bond B Bond C

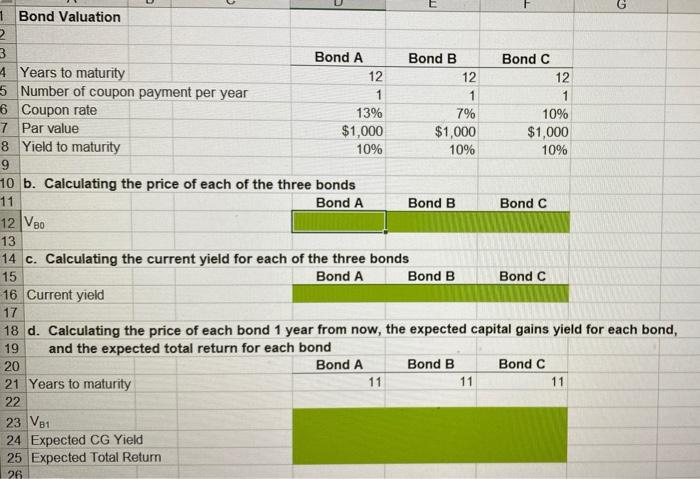

SP RE N a a w F G 1 Bond Valuation 2 3 Bond A Bond B Bond C 4 Years to maturity 12 12 12 5 Number of coupon payment per year 1 1 6 Coupon rate 13% 7% 10% 7 Par value $1,000 $1,000 $1,000 8 Yield to maturity 10% 10% 10% 9 10 b. Calculating the price of each of the three bonds 11 Bond A Bond B Bond C 12 V80 13 14 c. Calculating the current yield for each of the three bonds 15 Bond A Bond B Bond C 16 Current yield 17 18 d. Calculating the price of each bond 1 year from now, the expected capital gains yield for each bond, 19 and the expected total return for each bond 20 Bond A Bond B Bond C 21 Years to maturity 11 11 11 22 23 V81 24 Expected CG Yield 25 Expected Total Return 26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts