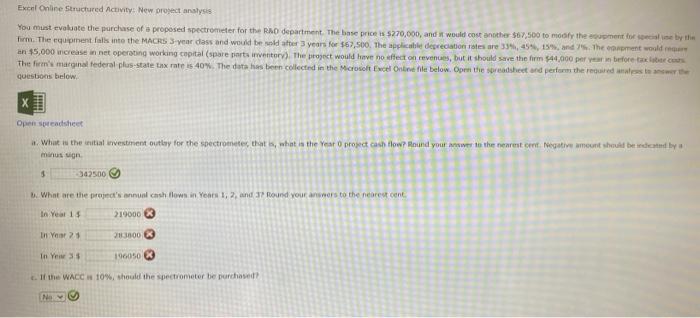

Question: Excel Online Structured Activity: New project analysis You must evaluate the purchase of a proposed spectrometer for the RAD department. The base price is $270,000,

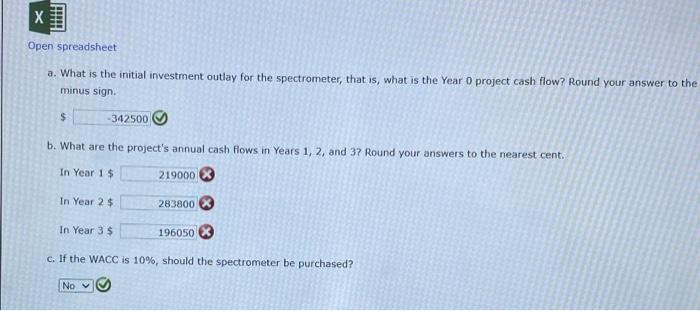

Excel Online Structured Activity: New project analysis You must evaluate the purchase of a proposed spectrometer for the RAD department. The base price is $270,000, and would cost another $67,500 to modify the count for ce by firm. The equipment falls into the MACRS 3 year dass and would be soldatter 3 years for $67,500. The applicabile depreciation rates are 334,454,15,and. The man would an $5,000 increase in net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save the firm 544,000 per year before albercus The firm's marginal federal plus state tax rate is 40%. The data has been collected in the Microsoft Excel Online ble below. Open the spreadsheet and perform the record stew questions below X THIS Open spreadsheet What is the initial investment outlay for the spectrometer that is what is the Year o proxect cash flow? Hound your answer to the nearest Negative amount should be cand by a minus $ 342500 What are the project's annual cash down.in Yeats 1, 2, and I round your answers to the nearest cont In Year 15 219000 In Y 21 3000 In Y 33 196050 If the WACC # 10%, should the spectrometer be purchased X Open spreadsheet a. What is the initial investment outlay for the spectrometer, that is, what is the Year O project cash flow? Round your answer to the minus sign -342500 $ b. What are the project's annual cash flows in Years 1, 2, and 3? Round your answers to the nearest cent. In Year 1$ 219000 In Year 2$ 283800 In Year 3 $ 196050 c. If the WACC is 10%, should the spectrometer be purchased? No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts