Question: Excel Problem 4 Show All Excel Work (18 Points) You are evaluating two mutually exclusive projects, A and B. The cash flows are below. What

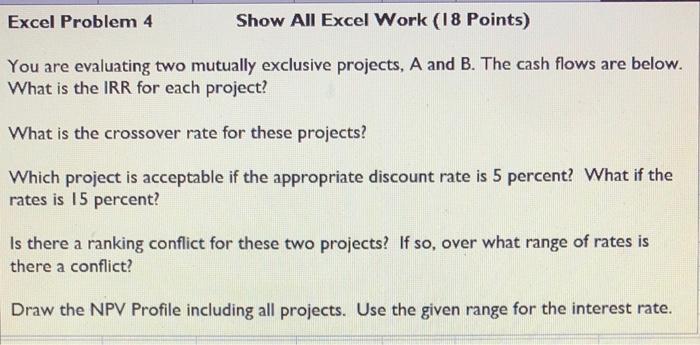

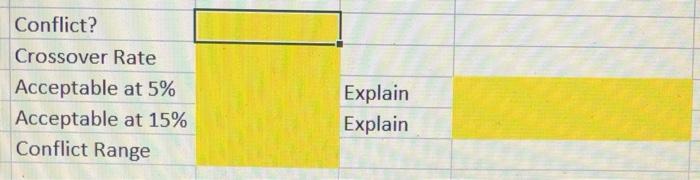

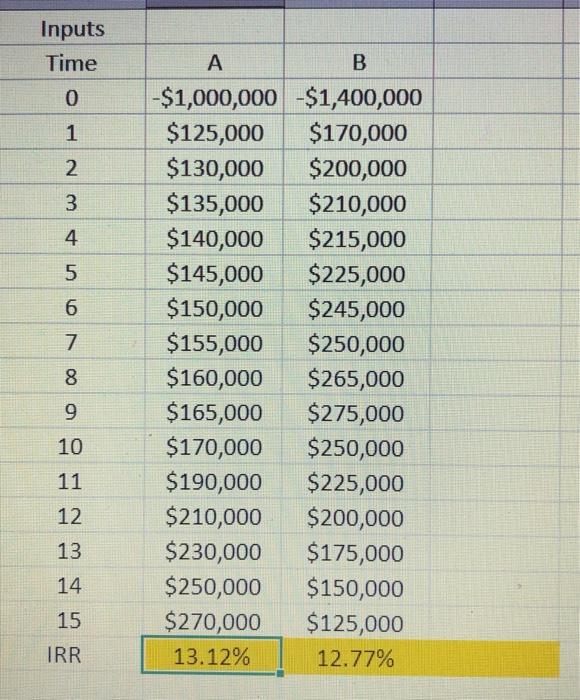

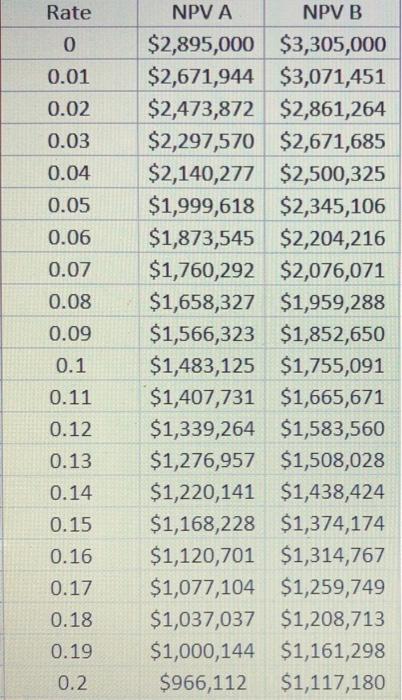

Excel Problem 4 Show All Excel Work (18 Points) You are evaluating two mutually exclusive projects, A and B. The cash flows are below. What is the IRR for each project? What is the crossover rate for these projects? Which project is acceptable if the appropriate discount rate is 5 percent? What if the rates is 15 percent? Is there a ranking conflict for these two projects? If so, over what range of rates is there a conflict? Draw the NPV Profile including all projects. Use the given range for the interest rate. Conflict? Crossover Rate Acceptable at 5% Acceptable at 15% Conflict Range Explain Explain Inputs Time 0 1 2 3 4 5 6 7 A B -$1,000,000 -$1,400,000 $125,000 $170,000 $130,000 $200,000 $135,000 $210,000 $140,000 $215,000 $145,000 $225,000 $150,000 $245,000 $155,000 $250,000 $160,000 $265,000 $165,000 $275,000 $170,000 $250,000 $190,000 $225,000 $210,000 $200,000 $230,000 $175,000 $250,000 $150,000 $270,000 $125,000 13.12% 12.77% 8 9 10 11 12 13 14 15 IRR Rate 0 0.01 0.02 0.03 0.04 0.05 0.06 0.07 0.08 0.09 NPVA NPV B $2,895,000 $3,305,000 $ $2,671,944 $3,071,451 $2,473,872 $2,861,264 $2,297,570 $2,671,685 $ $2,140,277 $2,500,325 $1,999,618 $2,345,106 $ $1,873,545 $2,204,216 $1,760,292 $2,076,071 $ $1,658,327 $1,959,288 $1,566,323 $1,852,650 $ $1,483,125 $1,755,091 $1,407,731 $1,665,671 $1,339,264 $1,583,560 $1,276,957 $1,508,028 $ $1,220,141 $1,438,424 $1,168,228 $1,374,174 $1,120,701 $1,314,767 $1,077,104 $1,259,749 $1,037,037 $1,208,713 $1,000,144 $1,161,298 $ $966,112 $1,117,180 0.1 0.11 0.12 0.13 0.14 0.15 0.16 0.17 0.18 0.19 0.2 Excel Problem 4 Show All Excel Work (18 Points) You are evaluating two mutually exclusive projects, A and B. The cash flows are below. What is the IRR for each project? What is the crossover rate for these projects? Which project is acceptable if the appropriate discount rate is 5 percent? What if the rates is 15 percent? Is there a ranking conflict for these two projects? If so, over what range of rates is there a conflict? Draw the NPV Profile including all projects. Use the given range for the interest rate. Conflict? Crossover Rate Acceptable at 5% Acceptable at 15% Conflict Range Explain Explain Inputs Time 0 1 2 3 4 5 6 7 A B -$1,000,000 -$1,400,000 $125,000 $170,000 $130,000 $200,000 $135,000 $210,000 $140,000 $215,000 $145,000 $225,000 $150,000 $245,000 $155,000 $250,000 $160,000 $265,000 $165,000 $275,000 $170,000 $250,000 $190,000 $225,000 $210,000 $200,000 $230,000 $175,000 $250,000 $150,000 $270,000 $125,000 13.12% 12.77% 8 9 10 11 12 13 14 15 IRR Rate 0 0.01 0.02 0.03 0.04 0.05 0.06 0.07 0.08 0.09 NPVA NPV B $2,895,000 $3,305,000 $ $2,671,944 $3,071,451 $2,473,872 $2,861,264 $2,297,570 $2,671,685 $ $2,140,277 $2,500,325 $1,999,618 $2,345,106 $ $1,873,545 $2,204,216 $1,760,292 $2,076,071 $ $1,658,327 $1,959,288 $1,566,323 $1,852,650 $ $1,483,125 $1,755,091 $1,407,731 $1,665,671 $1,339,264 $1,583,560 $1,276,957 $1,508,028 $ $1,220,141 $1,438,424 $1,168,228 $1,374,174 $1,120,701 $1,314,767 $1,077,104 $1,259,749 $1,037,037 $1,208,713 $1,000,144 $1,161,298 $ $966,112 $1,117,180 0.1 0.11 0.12 0.13 0.14 0.15 0.16 0.17 0.18 0.19 0.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts