Question: Excel Problem: Use the file Excel Markowitz.Model and solve the following problems. Please submit the weights you obtain as well the resulting expected return, volatility,

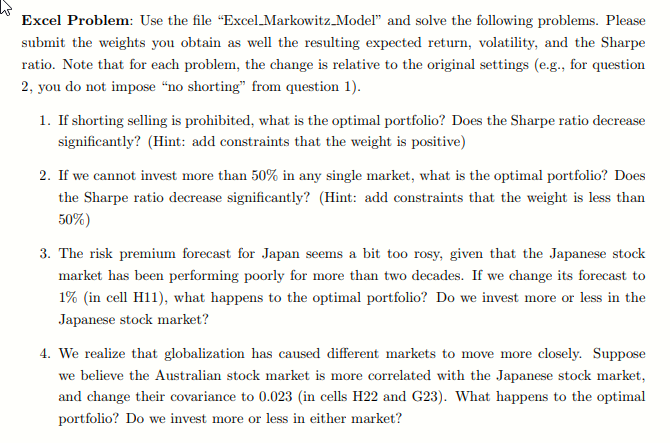

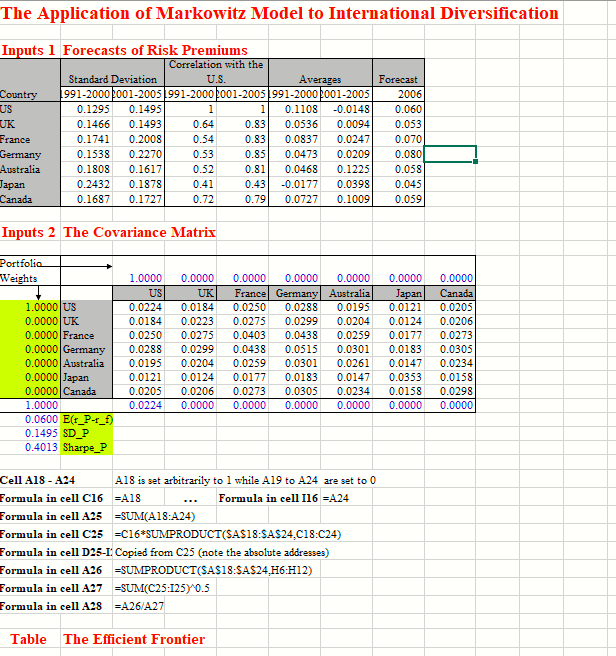

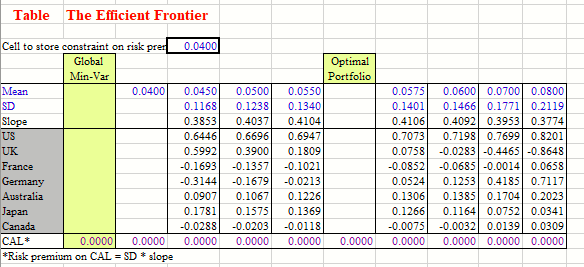

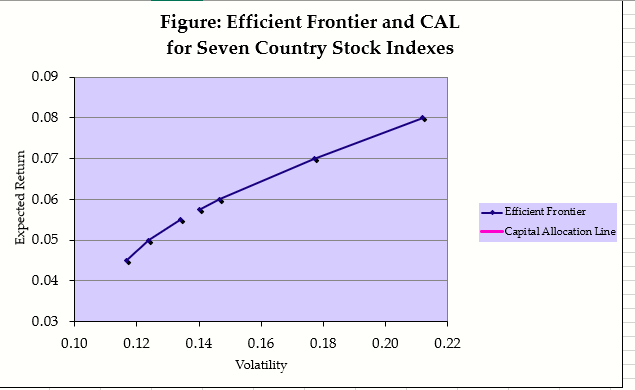

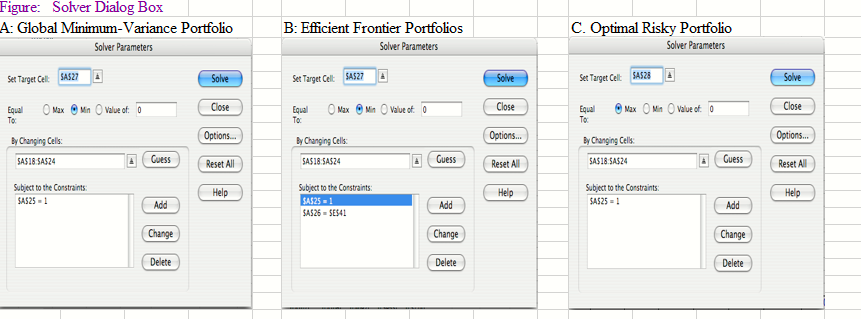

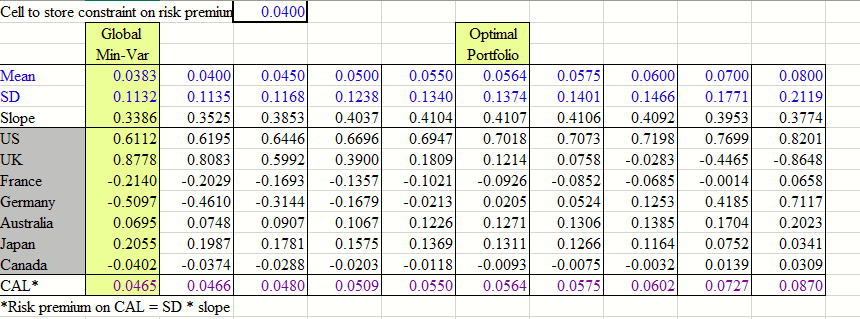

Excel Problem: Use the file "Excel Markowitz.Model" and solve the following problems. Please submit the weights you obtain as well the resulting expected return, volatility, and the Sharpe ratio. Note that for each problem, the change is relative to the original settings (e.g., for question 2, you do not impose "no shorting" from question 1). l. If shorting selling is prohaibited, what is the optimal poartolino? Daoes the Sharpe ratio decrease significantly? (Hint: add constraints that the weight is positive) 2. If we cannot invest more than 50% in any single market, what is the optimal portfolio? Does the Sharpe ratio decrease significantly (Hint: add constraints that the weight is less than 50%) 3. The risk premium forecast for Japan seems a bit too rosy, given that the Japanese stock market has been performing poorly for more than two decades. If we change its forecast to 1% (in cell H11), what happens to the optimal portfolio? Do we invest more or less in the Japanese stock market? 4. We realize that globalization has caused different markets to move more closely. Suppose we believe the Australian stock market is more correlated with the Japanese stock market and change their covariance to 0.023 (in cells H22 and G23). What happens to the optimal portfolio? Do we invest more or less in either market? Excel Problem: Use the file "Excel Markowitz.Model" and solve the following problems. Please submit the weights you obtain as well the resulting expected return, volatility, and the Sharpe ratio. Note that for each problem, the change is relative to the original settings (e.g., for question 2, you do not impose "no shorting" from question 1). l. If shorting selling is prohaibited, what is the optimal poartolino? Daoes the Sharpe ratio decrease significantly? (Hint: add constraints that the weight is positive) 2. If we cannot invest more than 50% in any single market, what is the optimal portfolio? Does the Sharpe ratio decrease significantly (Hint: add constraints that the weight is less than 50%) 3. The risk premium forecast for Japan seems a bit too rosy, given that the Japanese stock market has been performing poorly for more than two decades. If we change its forecast to 1% (in cell H11), what happens to the optimal portfolio? Do we invest more or less in the Japanese stock market? 4. We realize that globalization has caused different markets to move more closely. Suppose we believe the Australian stock market is more correlated with the Japanese stock market and change their covariance to 0.023 (in cells H22 and G23). What happens to the optimal portfolio? Do we invest more or less in either market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts