Question: Use the file Excel_Markowitz_Model and solve the following problems. Please submit the portfolio weights you obtain as well as the resulting expected return, volatility, and

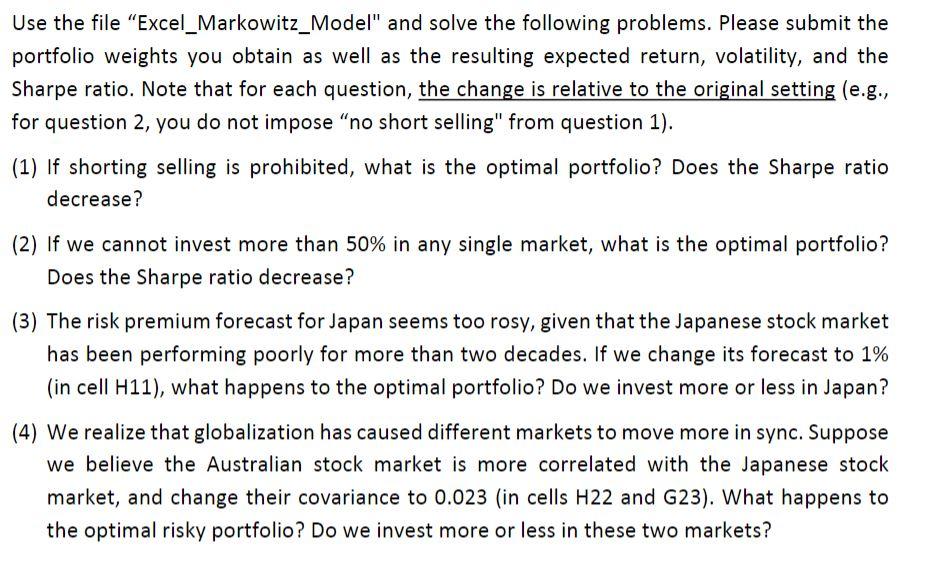

Use the file "Excel_Markowitz_Model" and solve the following problems. Please submit the portfolio weights you obtain as well as the resulting expected return, volatility, and the Sharpe ratio. Note that for each question, the change is relative to the original setting (e.g., for question 2, you do not impose "no short selling" from question 1). (1) If shorting selling is prohibited, what is the optimal portfolio? Does the Sharpe ratio decrease? (2) If we cannot invest more than 50% in any single market, what is the optimal portfolio? Does the Sharpe ratio decrease? (3) The risk premium forecast for Japan seems too rosy, given that the Japanese stock market has been performing poorly for more than two decades. If we change its forecast to 1% (in cell H11 ), what happens to the optimal portfolio? Do we invest more or less in Japan? (4) We realize that globalization has caused different markets to move more in sync. Suppose we believe the Australian stock market is more correlated with the Japanese stock market, and change their covariance to 0.023 (in cells H22 and G23 ). What happens to the optimal risky portfolio? Do we invest more or less in these two markets? Use the file "Excel_Markowitz_Model" and solve the following problems. Please submit the portfolio weights you obtain as well as the resulting expected return, volatility, and the Sharpe ratio. Note that for each question, the change is relative to the original setting (e.g., for question 2, you do not impose "no short selling" from question 1). (1) If shorting selling is prohibited, what is the optimal portfolio? Does the Sharpe ratio decrease? (2) If we cannot invest more than 50% in any single market, what is the optimal portfolio? Does the Sharpe ratio decrease? (3) The risk premium forecast for Japan seems too rosy, given that the Japanese stock market has been performing poorly for more than two decades. If we change its forecast to 1% (in cell H11 ), what happens to the optimal portfolio? Do we invest more or less in Japan? (4) We realize that globalization has caused different markets to move more in sync. Suppose we believe the Australian stock market is more correlated with the Japanese stock market, and change their covariance to 0.023 (in cells H22 and G23 ). What happens to the optimal risky portfolio? Do we invest more or less in these two markets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts