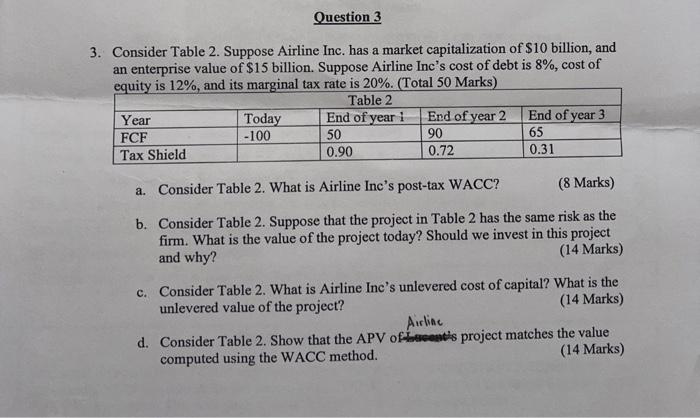

Question: excel Question 3 3. Consider Table 2. Suppose Airline Inc. has a market capitalization of $10 billion, and an enterprise value of $15 billion. Suppose

Question 3 3. Consider Table 2. Suppose Airline Inc. has a market capitalization of $10 billion, and an enterprise value of $15 billion. Suppose Airline Inc's cost of debt is 8%, cost of equity is 12%, and its marginal tax rate is 20%. (Total 50 Marks) a. Consider Table 2. What is Airline Inc's post-tax WACC? (8 Marks) b. Consider Table 2. Suppose that the project in Table 2 has the same risk as the firm. What is the value of the project today? Should we invest in this project and why? (14 Marks) c. Consider Table 2. What is Airline Inc's unlevered cost of capital? What is the unlevered value of the project? (14 Marks) Airline d. Consider Table 2. Show that the APV of matches the value computed using the WACC method. (14 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts