Question: detailed answer 3. Consider Table 2. Suppose Media Inc, has an equity cost of capital of 10%, market capitalization of $10.8 billion, and an enterprise

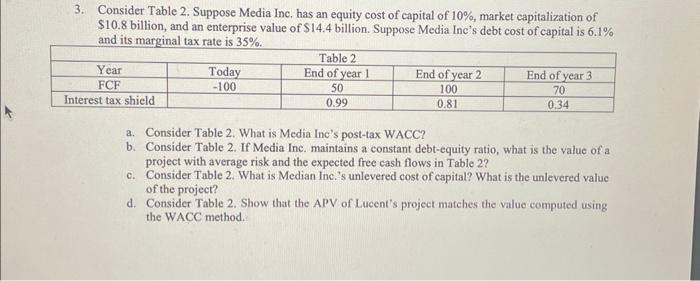

3. Consider Table 2. Suppose Media Inc, has an equity cost of capital of 10%, market capitalization of $10.8 billion, and an enterprise value of $14.4 billion. Suppose Media Inc's debt cost of capital is 6.1% and its marginal tax rate is 35%. a. Consider Table 2. What is Media Inc's post-tax WACC? b. Consider Table 2. If Media Inc. maintains a constant debt-equity ratio, what is the value of a project with average risk and the expected free cash flows in Table 2? c. Consider Table 2. What is Median Inc.'s unlevered cost of capital? What is the unlevered valuc of the project? d. Consider Table 2. Show that the APV of Lucent's project matehes the value computed using the WACC method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts