Question: Excel solution is required. XYZ Discount Electronics is planning a seven-day promotion on a discontinued model of a popular smart watch. Ata. Price of $575

Excel solution is required.

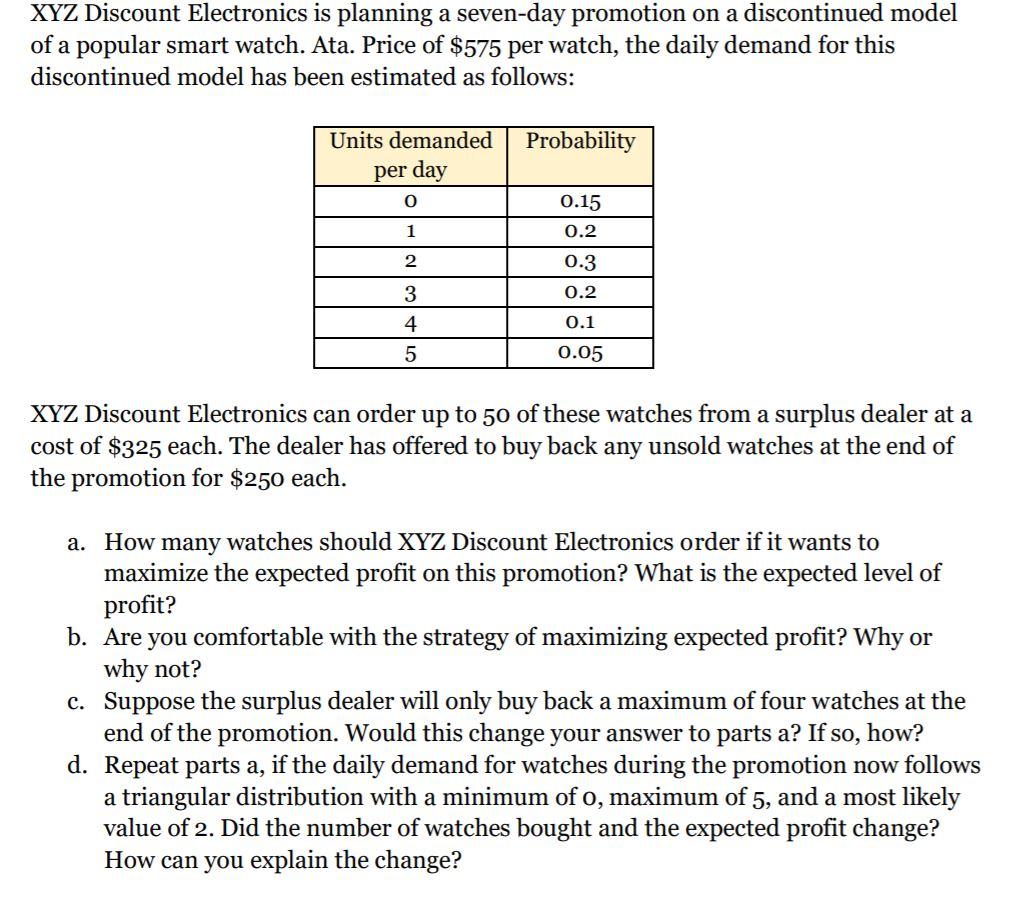

XYZ Discount Electronics is planning a seven-day promotion on a discontinued model of a popular smart watch. Ata. Price of $575 per watch, the daily demand for this discontinued model has been estimated as follows: Units demanded Probability per day O 0.15 1 0.2 2 0.3 3 0.2 4 0.1 5 0.05 XYZ Discount Electronics can order up to 50 of these watches from a surplus dealer at a cost of $325 each. The dealer has offered to buy back any unsold watches at the end of the promotion for $250 each. a. How many watches should XYZ Discount Electronics order if it wants to maximize the expected profit on this promotion? What is the expected level of profit? b. Are you comfortable with the strategy of maximizing expected profit? Why or why not? c. Suppose the surplus dealer will only buy back a maximum of four watches at the end of the promotion. Would this change your answer to parts a? If so, how? d. Repeat parts a, if the daily demand for watches during the promotion now follows a triangular distribution with a minimum of o, maximum of 5, and a most likely value of 2. Did the number of watches bought and the expected profit change? How can you explain the change? XYZ Discount Electronics is planning a seven-day promotion on a discontinued model of a popular smart watch. Ata. Price of $575 per watch, the daily demand for this discontinued model has been estimated as follows: Units demanded Probability per day O 0.15 1 0.2 2 0.3 3 0.2 4 0.1 5 0.05 XYZ Discount Electronics can order up to 50 of these watches from a surplus dealer at a cost of $325 each. The dealer has offered to buy back any unsold watches at the end of the promotion for $250 each. a. How many watches should XYZ Discount Electronics order if it wants to maximize the expected profit on this promotion? What is the expected level of profit? b. Are you comfortable with the strategy of maximizing expected profit? Why or why not? c. Suppose the surplus dealer will only buy back a maximum of four watches at the end of the promotion. Would this change your answer to parts a? If so, how? d. Repeat parts a, if the daily demand for watches during the promotion now follows a triangular distribution with a minimum of o, maximum of 5, and a most likely value of 2. Did the number of watches bought and the expected profit change? How can you explain the changeStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock