Question: excel will do if it shows how to solve and mark every answer 1. Consider the following two mutually exclusive projects. Assume the cost of

excel will do if it shows how to solve and mark every answer

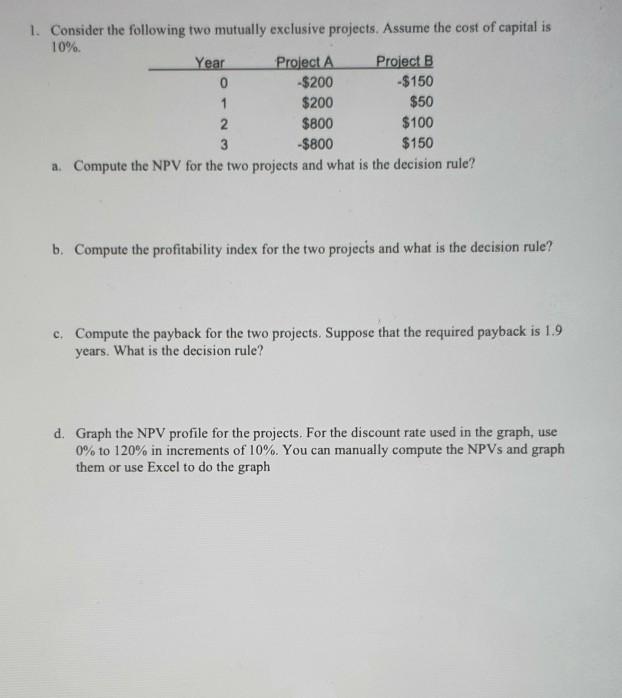

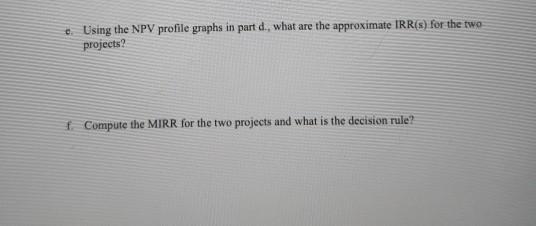

1. Consider the following two mutually exclusive projects. Assume the cost of capital is 10% Year Project A Project B 0 -$200 -$150 1 $200 $50 2 $800 $100 3 -$800 $150 a. Compute the NPV for the two projects and what is the decision rule? b. Compute the profitability index for the two projects and what is the decision rule? c. Compute the payback for the two projects. Suppose that the required payback is 1.9 years. What is the decision rule? d. Graph the NPV profile for the projects. For the discount rate used in the graph, use 0% to 120% in increments of 10%. You can manually compute the NPVs and graph them or use Excel to do the graph Using the NPV profile graphs in part d., what are the approximate IRR(s) for the two projects? f Compute the MIRR for the two projects and what is the decision rule

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts