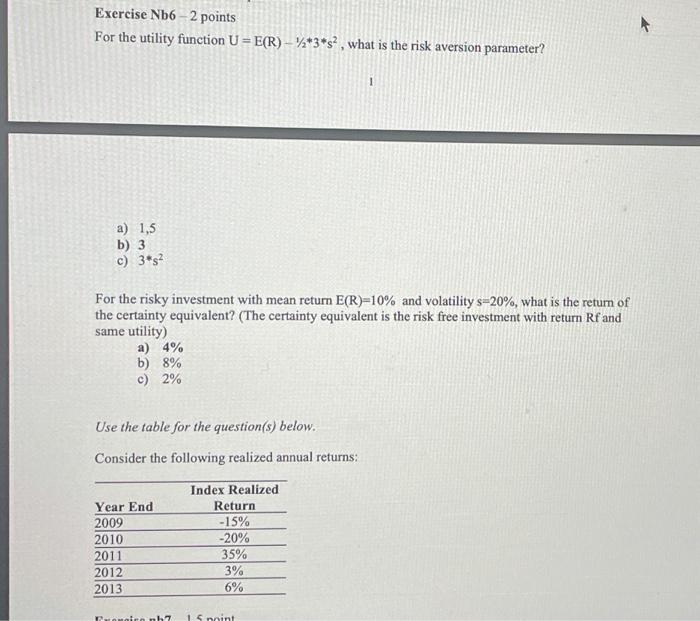

Question: exercice 5 : Exercise Nb6 2 points For the utility function U = E(R) *3*s 2 , what is the risk aversion parameter? 2 a)

Exercise Nb6 - 2 points For the utility function U = E(R) -"*3*s?, what is the risk aversion parameter? 1 a) 1,5 b) 3 c) 3*s? For the risky investment with mean return E(R)=10% and volatility s=20%, what is the return of the certainty equivalent? (The certainty equivalent is the risk free investment with return Rf and same utility) a) 4% b) 8% c) 2% Use the table for the question(s) below. Consider the following realized annual returns: Year End 2009 2010 2011 2012 2013 Index Realized Return -15% -20% 35% 3% 6% Turnby 1 Soint

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts