Question: Exercise 1 (13 points) Walker Co. had a machine which it purchased for $1,200,000 on January 1, 2016. This old machine had an estimated life

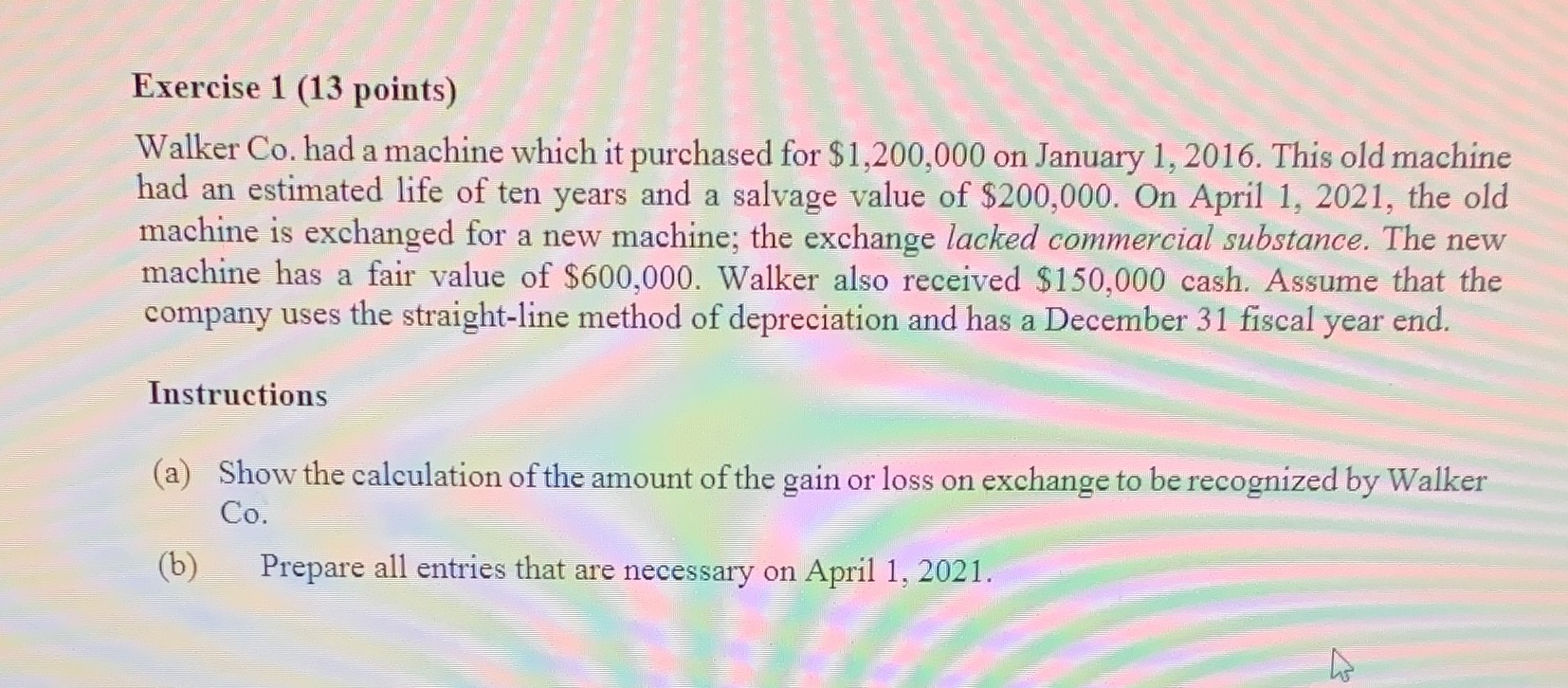

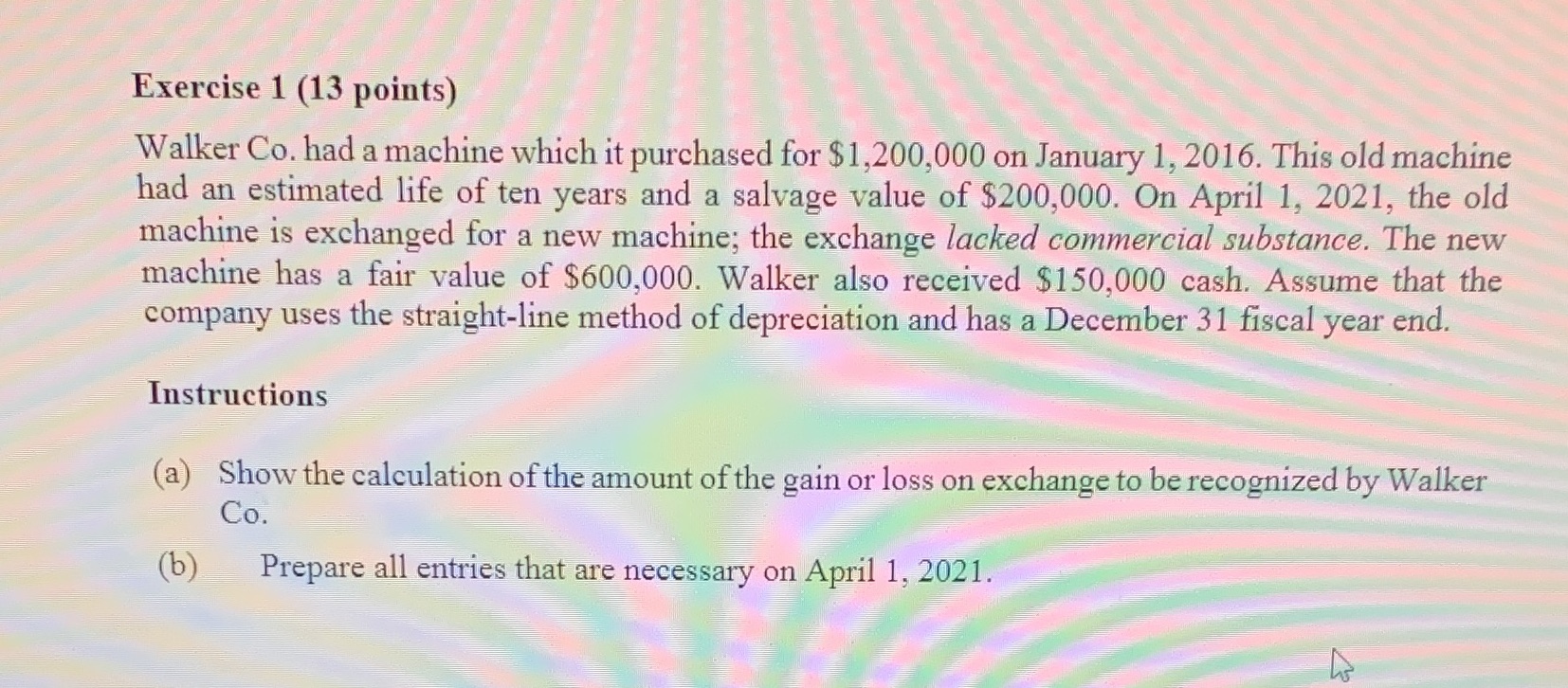

Exercise 1 (13 points) Walker Co. had a machine which it purchased for $1,200,000 on January 1, 2016. This old machine had an estimated life of ten years and a salvage value of $200,000. On April 1, 2021, the old machine is exchanged for a new machine; the exchange lacked commercial substance. The new machine has a fair value of $600,000. Walker also received $150,000 cash. Assume that the company uses the straight-line method of depreciation and has a December 31 fiscal year end. Instructions (a) Show the calculation of the amount of the gain or loss on exchange to be recognized by Walker Co. ( b ) Prepare all entries that are necessary on April 1, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts