Question: Question 4 (25 marks) Part 1 (13 marks) On 2 January 2016, Derwent Ltd purchased a machine for $35 000 plus GST with a useful

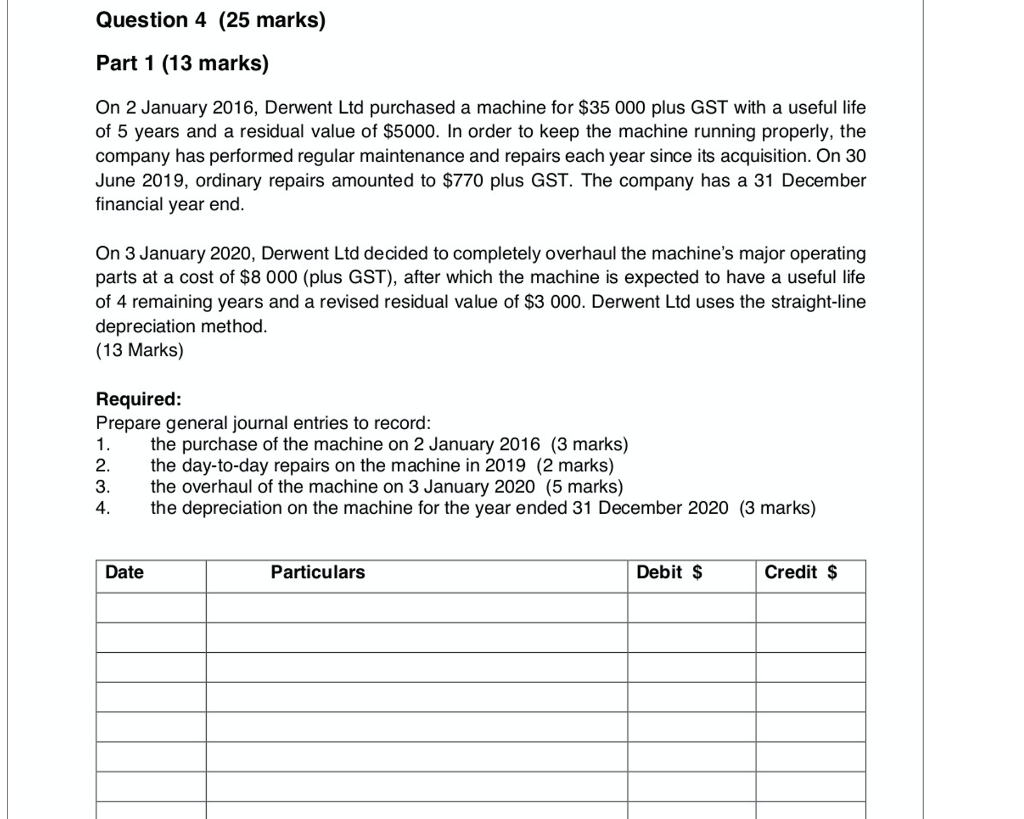

Question 4 (25 marks) Part 1 (13 marks) On 2 January 2016, Derwent Ltd purchased a machine for $35 000 plus GST with a useful life of 5 years and a residual value of $5000. In order to keep the machine running properly, the company has performed regular maintenance and repairs each year since its acquisition. On 30 June 2019, ordinary repairs amounted to $770 plus GST. The company has a 31 December financial year end. On 3 January 2020, Derwent Ltd decided to completely overhaul the machine's major operating parts at a cost of $8 000 (plus GST), after which the machine is expected to have a useful life of 4 remaining years and a revised residual value of $3 000. Derwent Ltd uses the straight-line depreciation method. (13 Marks) Required: Prepare general journal entries to record: 1. the purchase of the machine on 2 January 2016 (3 marks) 2. the day-to-day repairs on the machine in 2019 (2 marks) 3. the overhaul of the machine on 3 January 2020 (5 marks) 4. the depreciation on the machine for the year ended 31 December 2020 (3 marks) Date Particulars Debit $ Credit $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts