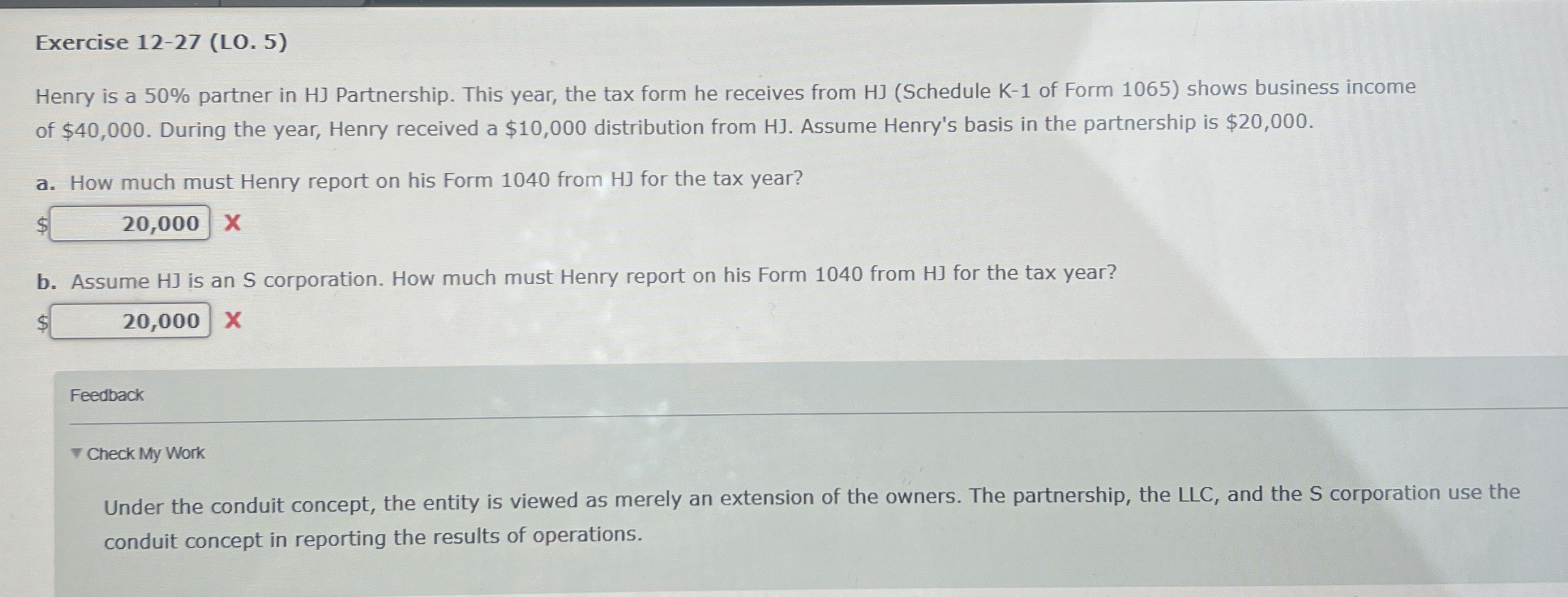

Question: Exercise 1 2 - 2 7 ( LO . 5 ) Henry is a 5 0 % partner in HJ Partnership. This year, the tax

Exercise LO

Henry is a partner in HJ Partnership. This year, the tax form he receives from HJ Schedule K of Form shows business income of $ During the year, Henry received a $ distribution from HJ Assume Henry's basis in the partnership is $

a How much must Henry report on his Form from HJ for the tax year?

b Assume HJ is an S corporation. How much must Henry report on his Form from HJ for the tax year?

Feedback

Check My Work

Under the conduit concept, the entity is viewed as merely an extension of the owners. The partnership, the LLC and the S corporation use the conduit concept in reporting the results of operations.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock