Question: Exercise 13-32 (Algorithmic) (LO. 5) Henry is a 30% partner in HJ Partnership. For 2016, the tax form he receives from HJ (Schedule K-1 of

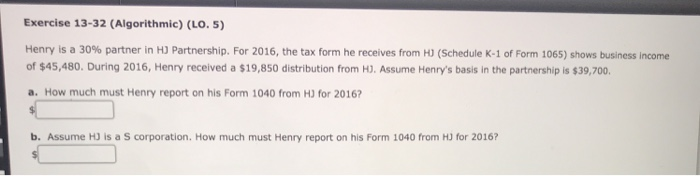

Exercise 13-32 (Algorithmic) (LO. 5) Henry is a 30% partner in HJ Partnership. For 2016, the tax form he receives from HJ (Schedule K-1 of Form 1065) shows business income of $45,480. During 2016, Henry received a $19,850 distribution from H). Assume Henry's basis in the partnership is $39,700. a. How much must Henry report on his Form 1040 from HJ for 2016 b. Assume H3 is a S corporation. How much must Henry report on his Form 1040 from HJ for 2016

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts