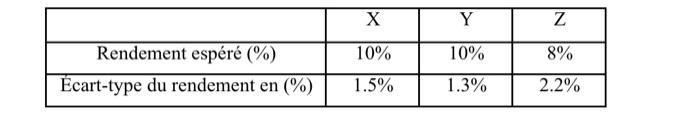

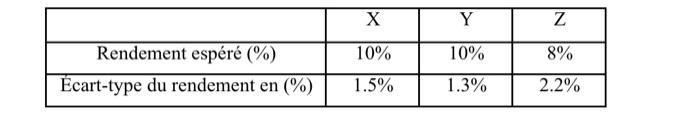

Question: Exercise 1 (3 points) Consider the following data for the three securities X, Y, and Z: X Y Z Expected return (%) 10% 10% 8%

Exercise 1 (3 points) Consider the following data for the three securities X, Y, and Z: X Y Z Expected return (%) 10% 10% 8% Standard deviation of return in (%) 1.5% 1.3% 2.2% a) If you had to choose only one of these three stocks to invest in, which one would you choose? Why ? b) Suppose you hold a portfolio P made up of securities X and Y with the proportions 58% and 42% respectively. Knowing that the correlation coefficient between the returns of these two securities is 0.55, calculate for this portfolio: the expected return the risk of this portfolio, estimated using the standard deviation of its returns c) Is it advantageous to hold this portfolio P compared to holding individual securities? Why?

X Y Z 10% 10% 8% Rendement espr (%) Ecart-type du rendement en (%) 1.5% 1.3% 2.2%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock