Question: Exercise 1: Consider the below mistakes and indicate their effect on the following financial statement accounts: COGS, Gross Profit, Net Income, Total Assets, Equity, Operating

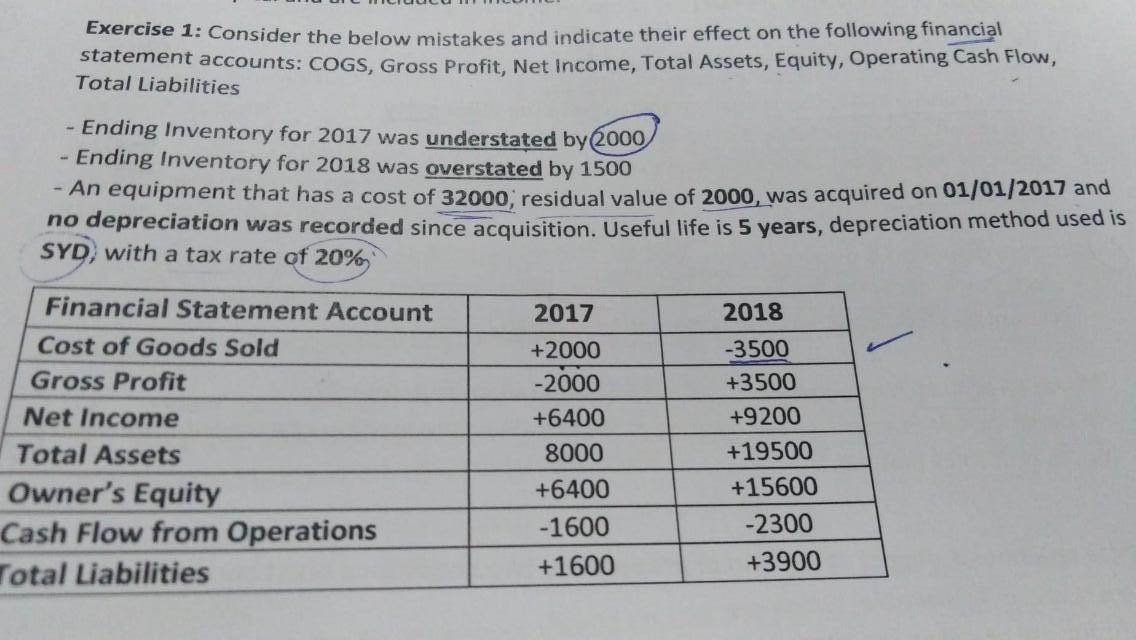

Exercise 1: Consider the below mistakes and indicate their effect on the following financial statement accounts: COGS, Gross Profit, Net Income, Total Assets, Equity, Operating Cash Flow, Total Liabilities - Ending Inventory for 2017 was understated by 2000 - Ending Inventory for 2018 was overstated by 1500 - An equipment that has a cost of 32000, residual value of 2000, was acquired on 01/01/2017 and no depreciation was recorded since acquisition. Useful life is 5 years, depreciation method used is SYD, with a tax rate of 20% Financial Statement Account Cost of Goods Sold Gross Profit Net Income Total Assets Owner's Equity Cash Flow from Operations Total Liabilities 2017 +2000 -2000 +6400 8000 +6400 -1600 +1600 2018 -3500 +3500 +9200 +19500 +15600 -2300 +3900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts