Question: Prepare an Income statement with the information shown on the profitability ratio tab the years of 2006 & 2007. - Consider that equipment depreciates

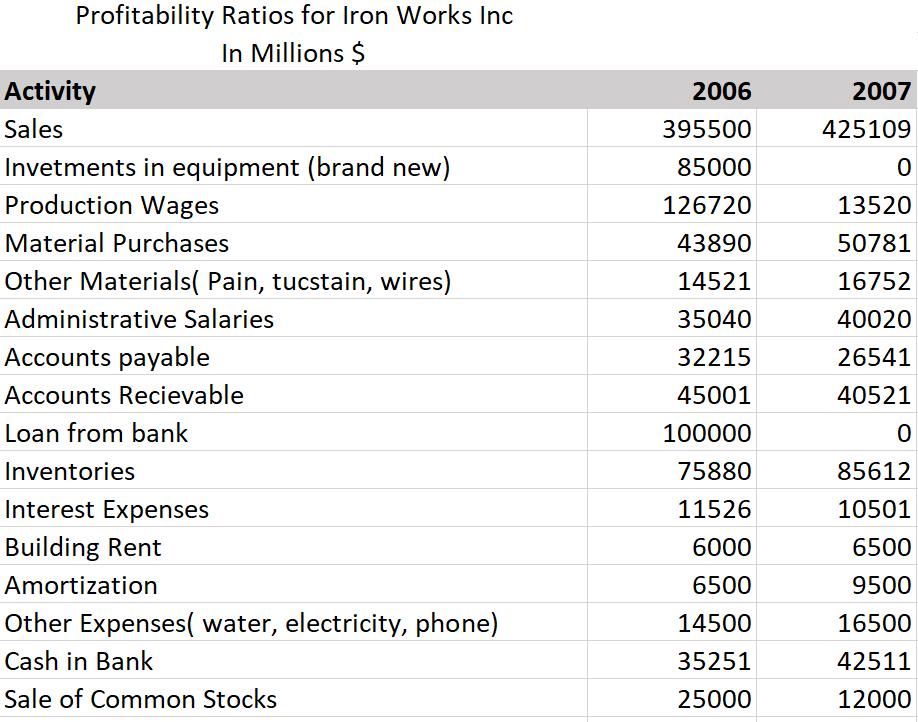

Prepare an Income statement with the information shown on the profitability ratio tab the years of 2006 & 2007. - Consider that equipment depreciates linearly over a span of 5 years with a surplus value of $13,000. - The firm is taxed at a 10% rate each year Exercise 2 Using the information of exercise 1 prepare a balance sheet for 2006 & 2007 Exercise 3 Prepare a cash flow statement using the information of exercise 1 & 2 for 2006 & 2007. Exercise 4 Using the information from the preview exercises calculate the following financial ratios - Current ratio - Quick Ratio - Working Capital - Debt/net worth - ROA - ROE - Inventory Turn Over - Accounts Receivable turnover in days - Net profit margin - ROI Exercise 5 Write an analysis of the company based on its liquidity, profitability and debt capacity (150-200 WORDS) Exercise 6 Is this company eligible for a $200,000 loan? explain your answer Profitability Ratios for Iron Works Inc In Millions $ Activity 2006 2007 Sales 395500 425109 Invetments in equipment (brand new) 85000 Production Wages 126720 13520 Material Purchases 43890 50781 Other Materials( Pain, tucstain, wires) 14521 16752 Administrative Salaries 35040 40020 Accounts payable 32215 26541 Accounts Recievable 45001 40521 Loan from bank 100000 Inventories 75880 85612 Interest Expenses 11526 10501 Building Rent 6000 6500 Amortization 6500 9500 Other Expenses( water, electricity, phone) 14500 16500 Cash in Bank 35251 42511 Sale of Common Stocks 25000 12000

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

1 Profit and Loss statement of the iron works Inc in Particulars 2006 2007 Sales 395500 4251... View full answer

Get step-by-step solutions from verified subject matter experts