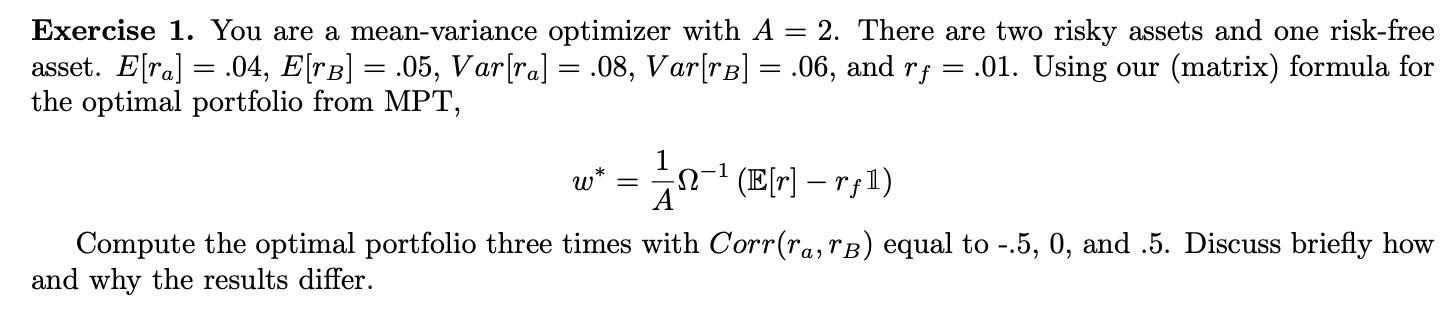

Question: = Exercise 1. You are a mean-variance optimizer with A = 2. There are two risky assets and one risk-free asset. E[ra] = .04, E[TB]

= Exercise 1. You are a mean-variance optimizer with A = 2. There are two risky assets and one risk-free asset. E[ra] = .04, E[TB] = .05, Var[ra] = .08, Var[ro] = .06, and rf =.01. Using our (matrix) formula for the optimal portfolio from MPT, 1 sk w ) -12-7 (E[r] r81) A Compute the optimal portfolio three times with Corr(ra, TB) equal to -.5, 0, and .5. Discuss briefly how and why the results differ

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts