Question: Exercise 10-16 Your answer is partially correct. Try agan. Marin Industries purchased the following assets and constructed a building as Assets 1 and 2: These

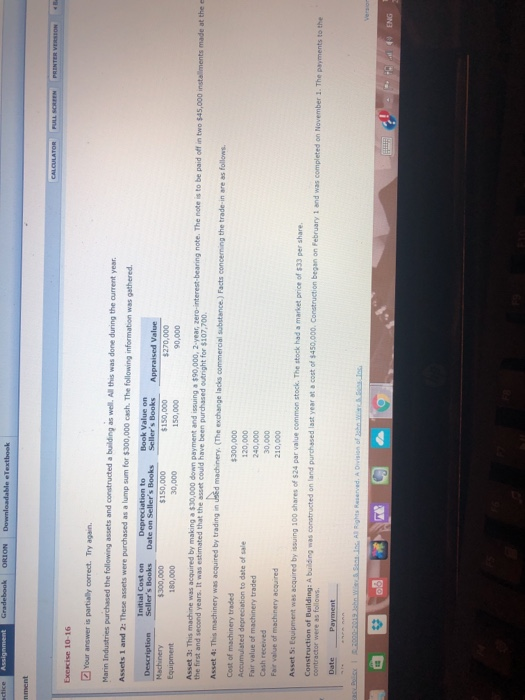

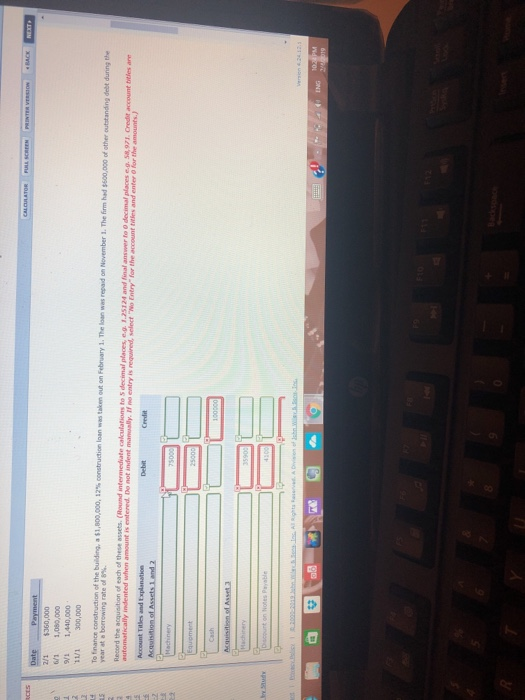

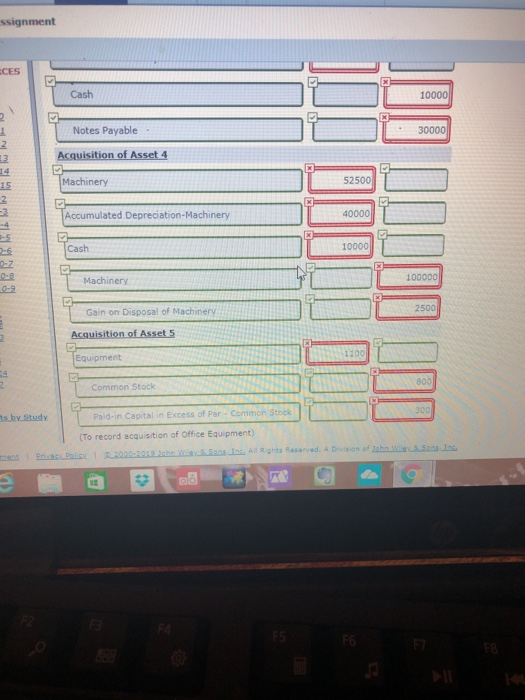

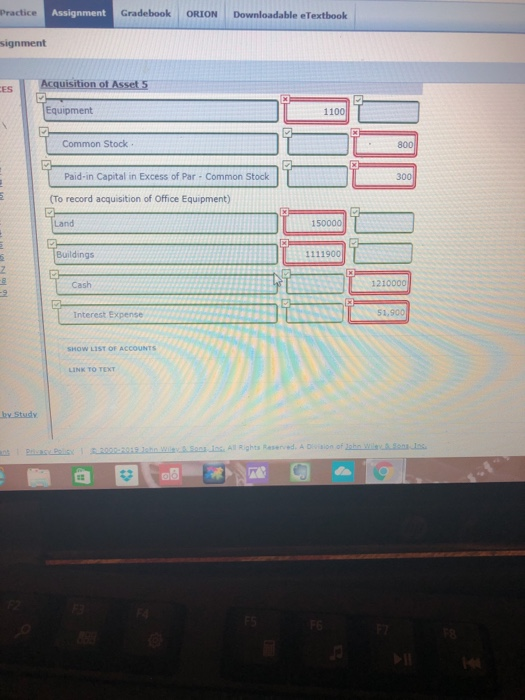

Exercise 10-16 Your answer is partially correct. Try agan. Marin Industries purchased the following assets and constructed a building as Assets 1 and 2: These assets were purchased well. All this was as a lump sum for $300,000 cash. The following information was gathered Initial Cost on Book Value on $150,000 30,000 $270,000 90,000 Equipment 180,000 150,000 Asset 3: This machine was acquired by making a $30,000 down payment and issuing a $90,000, 2 the first and second years. It was estimated that the asset could have been purchased outright for $107,700 -year zero-interest-bearing note. The note is to be paid off in two $45,000 instalments made at the Asset 4: This machinery was acquired by trading in used machinery. (The exchange lacks commercial substance.) Facts Cost of machinery traded $300,000 120,000 240,000 Fair value of machinery traded Cash received Asset 5: Equipment was acquired by issuing 100 shares of $24 par value common stock. The stock had a market price of $33 per share Construction of Building: A building was constructed on land purchased last year at a cost of $450,000. Construction began on February 1 and was completed on November 1. The payments to ssignment Cash 10000 Notes Payable 30000 Machinery 52500 Accumulated Depreciation-Machinery Cash 10000 100000 Machinery 2500 Gain on Disposal of Machinery Equipment Common Stock ts by Study Paid-in Capital in Excess of Par- Common Stock (To record acquisition of Office Equipment) Practice Assignment Gradebook ORION Downloadable eTextbook signment ES Equipment Common Stock 800 Paid-in Capital in Excess of Par- Common Stock (To record acquisition of Office Equipment) Land Buildings 1111900 Cash 1210000 Interest Expense 51,90 SHOW LIST OF ACCOUNTS by Studly SAos All Rights Reserved. A Division of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts