Question: Exercise 10-18A Straight-line amortization for bonds issued at a premium LO 10-5On January 1, Year 1, Sayers Company issued $132,000 of five-year, 7 percent bonds

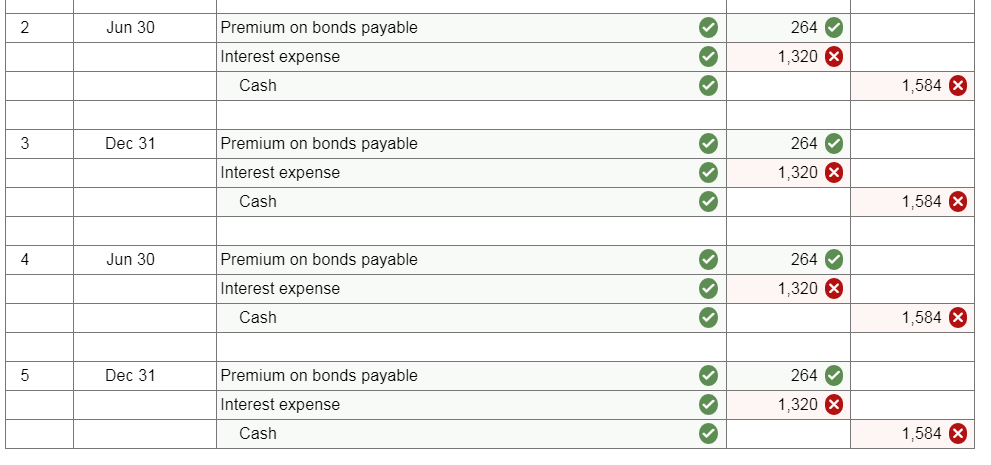

Exercise 10-18A Straight-line amortization for bonds issued at a premium LO 10-5On January 1, Year 1, Sayers Company issued $132,000 of five-year, 7 percent bonds at 102. Interest is payable semiannually on June 30 and December 31. The premium is amortized using the straight-line method. Required Prepare the journal entries to record the bond transactions for Year 1 and Year 2. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

I got the first part correct, but am having trouble computing the interest.

Jun 30 264 Premium on bonds payable Interest expense Cash 1,584 Dec 31 264 Premium on bonds payable Interest expense Cash 1,584 Jun 30 264 Premium on bonds payable Interest expense Cash 1,584 Dec 31 264 Premium on bonds payable Interest expense Cash 1,584

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts