Question: Exercise 10-5A Determining net present value LO 10-2 Jordan Company is considering investing in two new vans that are expected to generate combined cash inflows

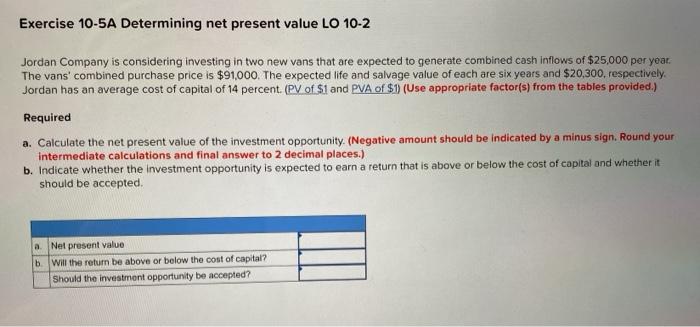

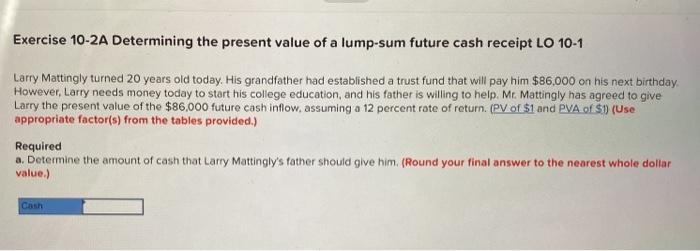

Exercise 10-5A Determining net present value LO 10-2 Jordan Company is considering investing in two new vans that are expected to generate combined cash inflows of $25,000 per year. The vans' combined purchase price is $91,000. The expected life and salvage value of each are six years and $20,300, respectively. Jordan has an average cost of capital of 14 percent. (PV of $1 and PVA of $1 (Use appropriate factor(s) from the tables provided.) Required a. Calculate the net present value of the investment opportunity. (Negative amount should be indicated by a minus sign. Round your intermediate calculations and final answer to 2 decimal places.) b. Indicate whether the investment opportunity is expected to earn a return that is above or below the cost of capital and whether it should be accepted a. Net present value b Will the return be above or below the cost of capital? Should the investment opportunity be accepted? Exercise 10-2A Determining the present value of a lump-sum future cash receipt LO 10-1 Larry Mattingly turned 20 years old today. His grandfather had established a trust fund that will pay him $86,000 on his next birthday However, Larry needs money today to start his college education, and his father is willing to help. Mr. Mattingly has agreed to give Larry the present value of the $86,000 future cash inflow, assuming a 12 percent rote of return. (PV of $1 and PVA of $1 (Use appropriate factor(s) from the tables provided.) Required a. Determine the amount of cash that Larry Mattingly's father should give him (Round your final answer to the nearest whole dollar value.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts