Question: Exercise 11-11 (LO. 5) Meredith, who is single, would like to contribute $6,000 to her Roth IRA. Her AGI is $126,000. In your computations, round

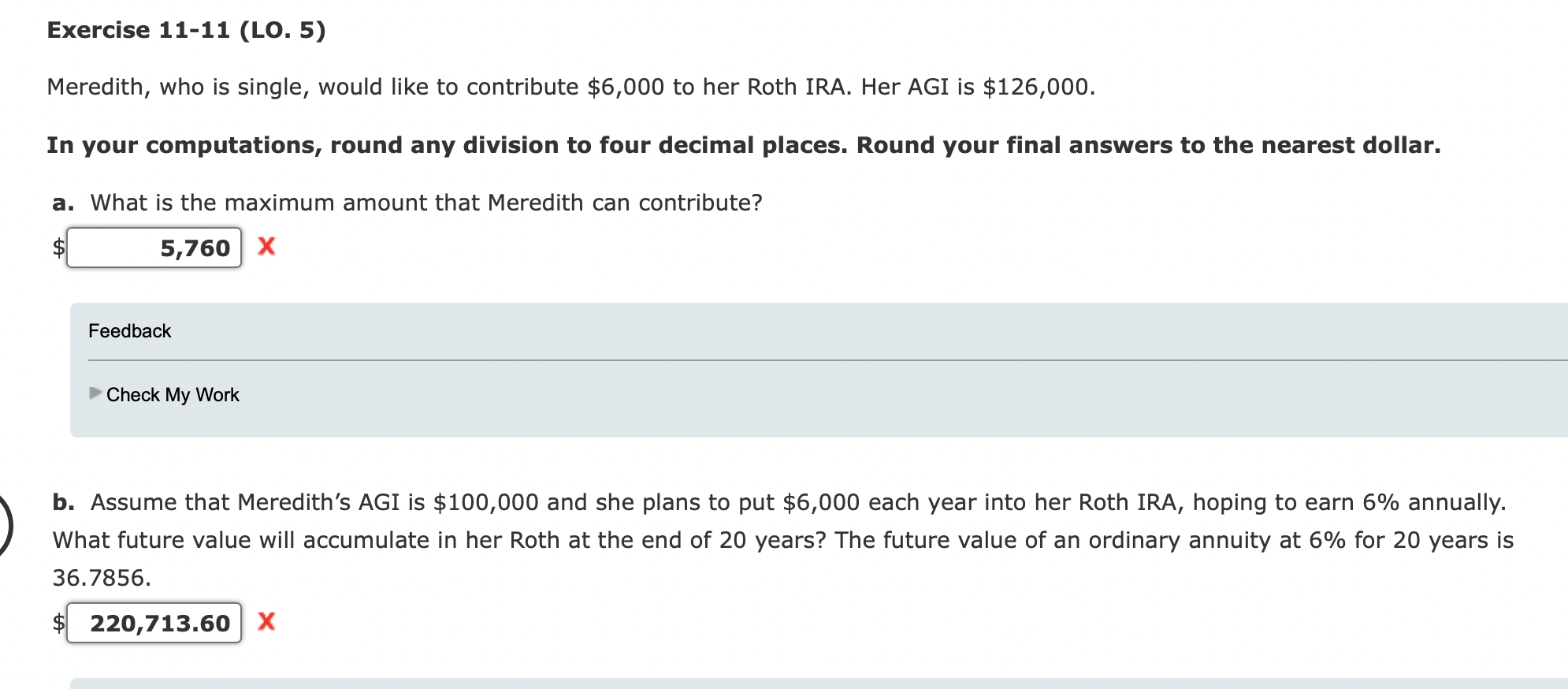

Exercise 11-11 (LO. 5) Meredith, who is single, would like to contribute $6,000 to her Roth IRA. Her AGI is $126,000. In your computations, round any division to four decimal places. Round your final answers to the nearest dollar. a. What is the maximum amount that Meredith can contribute? $ x Feedback Check My Work b. Assume that Meredith's AGI is $100,000 and she plans to put $6,000 each year into her Roth IRA, hoping to earn 6% annually. What future value will accumulate in her Roth at the end of 20 years? The future value of an ordinary annuity at 6% for 20 years is 36.7856. x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts