Question: Exercise 11-11 (LO. 5) Meredith, who is single, would like to contribute $6,000 to her Roth IRA. Her AGI is $126,000. In your computations, round

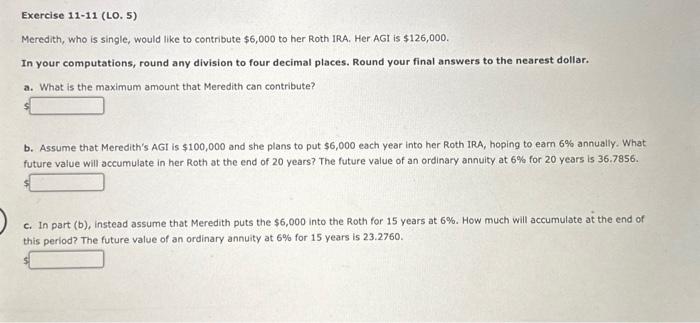

Exercise 11-11 (LO. 5) Meredith, who is single, would like to contribute $6,000 to her Roth IRA. Her AGI is $126,000. In your computations, round any division to four decimal places. Round your final answers to the nearest dollar. a. What is the maximum amount that Meredith can contribute? b. Assume that Meredith's AGI is $100,000 and she plans to put $6,000 each year into her Roth 1RA, hoping to earn 6% annually. What future value will accumulate in her Roth at the end of 20 years? The future value of an ordinary annuity at 6% for 20 years is 36.7856 . c. In part (b), instead assume that Meredith puts the $6,000 into the Roth for 15 years at 6%. How much will accumulate at the end of this period? The future value of an ordinary annuity at 6% for 15 years is 23.2760

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts