Question: Exercise 11-16 (Algorithmic) (LO. 7) Wylie is a general partner in a service-providing partnership and receives cash of $223,200 in liquidation of his partnership interest,

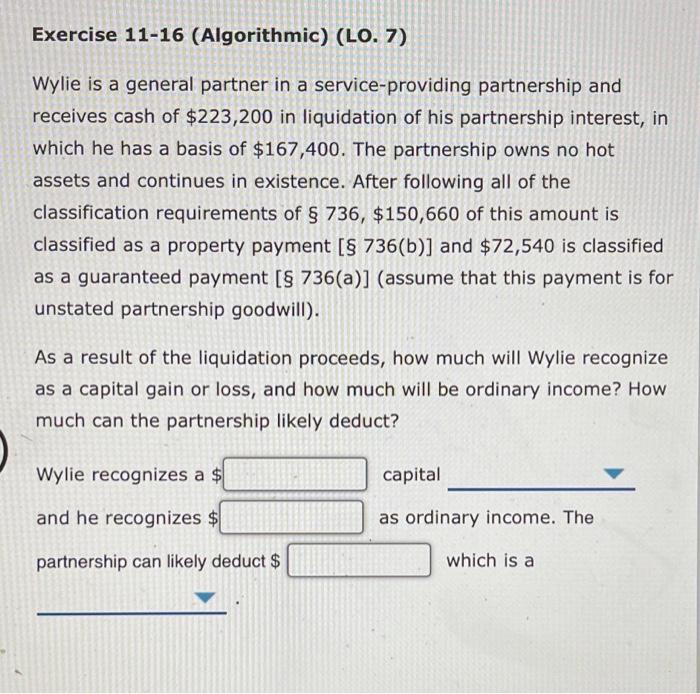

Exercise 11-16 (Algorithmic) (LO. 7) Wylie is a general partner in a service-providing partnership and receives cash of $223,200 in liquidation of his partnership interest, in which he has a basis of $167,400. The partnership owns no hot assets and continues in existence. After following all of the classification requirements of $ 736, $150,660 of this amount is classified as a property payment [S 736(b)] and $72,540 is classified as a guaranteed payment (S 736(a)] (assume that this payment is for unstated partnership goodwill). As a result of the liquidation proceeds, how much will Wylie recognize as a capital gain or loss, and how much will be ordinary income? How much can the partnership likely deduct? Wylie recognizes a $ capital and he recognizes $ as ordinary income. The partnership can likely deduct $ which is a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts