Question: please help ! all questions Exercise 13-36 (Algorithmic) (LO. 6) Logan and Johnathan exchange land, and the exchange qualifies as like kind under 5 1031.

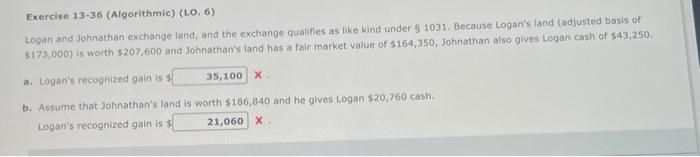

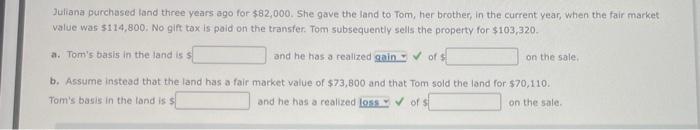

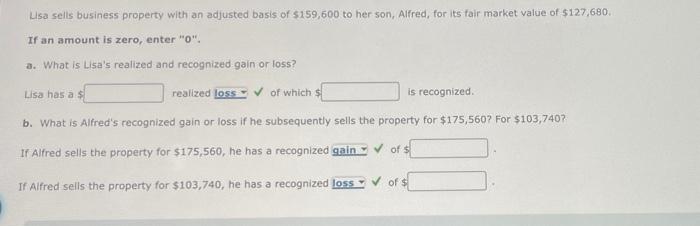

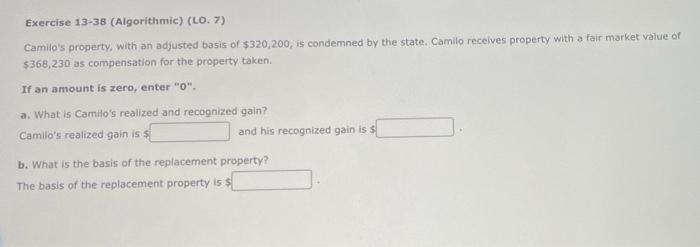

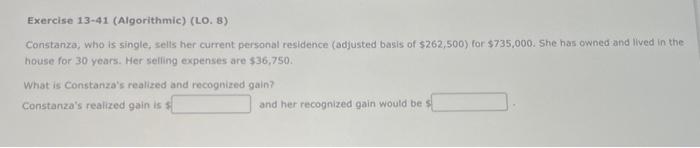

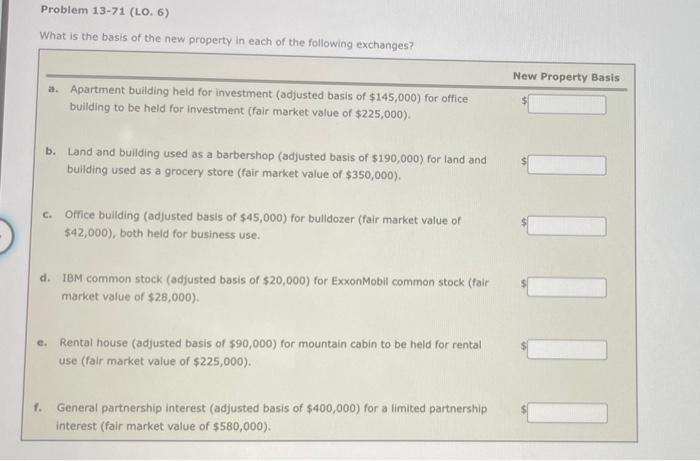

Exercise 13-36 (Algorithmic) (LO. 6) Logan and Johnathan exchange land, and the exchange qualifies as like kind under 5 1031. Because Logan's land (adjusted basis of $173,000) is worth $207,600 and Johnathan's land has a fair market value of $164,350, Johnathan also gives Logan cash of $43,250. a. Logan's recognized gain is s b. Assume that Johnathan's land is worth $186,840 and he gives Logan $20,760 cash. Logan's recognized gain is $ 21,060 X. 35,100 X Juliana purchased land three years ago for $82,000. She gave the land to Tom, her brother, in the current year, when the fair market value was $114,800. No gift tax is paid on the transfer. Tom subsequently sells the property for $103,320. a. Tom's basis in the land is s and he has a realized gain of s b. Assume instead that the land has a fair market value of $73,800 and that Tom sold the land for $70,110. Tom's basis in the land is s and he has a realized loss of s on the sale. on the sale, Lisa sells business property with an adjusted basis of $159,600 to her son, Alfred, for its fair market value of $127,680. If an amount is zero, enter "0". a. What is Lisa's realized and recognized gain or loss? realized loss of which is recognized. b. What is Alfred's recognized gain or loss if he subsequently sells the property for $175,560? For $103,740? If Alfred sells the property for $175,560, he has a recognized gain of $ If Alfred sells the property for $103,740, he has a recognized loss of $ Lisa has a $ Exercise 13-38 (Algorithmic) (LO. 7) Camilo's property, with an adjusted basis of $320,200, is condemned by the state. Camilo receives property with a fair market value of $368,230 as compensation for the property taken. If an amount is zero, enter "0". a. What is Camilo's realized and recognized gain? Camilo's realized gain is $ and his recognized gain is $ b. What is the basis of the replacement property? The basis of the replacement property is $ Exercise 13-41 (Algorithmic) (LO. 8) Constanza, who is single, sells her current personal residence (adjusted basis of $262,500) for $735,000. She has owned and lived in the house for 30 years. Her selling expenses are $36,750. What is Constanza's realized and recognized gain? Constanza's realized gain is $ and her recognized gain would be Problem 13-71 (LO. 6) What is the basis of the new property in each of the following exchanges? a. Apartment building held for investment (adjusted basis of $145,000) for office building to be held for investment (fair market value of $225,000). b. Land and building used as a barbershop (adjusted basis of $190,000) for land and building used as a grocery store (fair market value of $350,000). c. Office building (adjusted basis of $45,000) for bulldozer (fair market value of $42,000), both held for business use. d. IBM common stock (adjusted basis of $20,000) for ExxonMobil common stock (fair market value of $28,000). f. e. Rental house (adjusted basis of $90,000) for mountain cabin to be held for rental use (fair market value of $225,000). General partnership interest (adjusted basis of $400,000) for a limited partnership interest (fair market value of $580,000). New Property Basis |||||||

Step by Step Solution

There are 3 Steps involved in it

It looks like youve uploaded several images related to exercises involving real estate transactions tax implications and property exchanges I will analyze the content from these images and provide you ... View full answer

Get step-by-step solutions from verified subject matter experts