Question: Exercise 11-2 Recording known current liabilities LO C2 1. On July 15, Piper Co. sold $29,000 of merchandise (costing $14,500) for cash. The sales tax

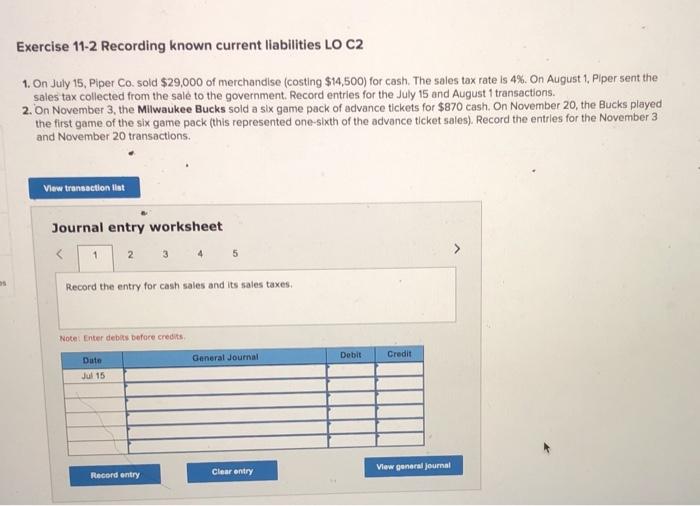

Exercise 11-2 Recording known current liabilities LO C2 1. On July 15, Piper Co. sold $29,000 of merchandise (costing $14,500) for cash. The sales tax rate is 4%. On August 1, Piper sent the sales tax collected from the sale to the government. Record entries for the July 15 and August 1 transactions. 2. On November 3, the Milwaukee Bucks sold a six game pack of advance tickets for $870 cash. On November 20, the Bucks played the first game of the six game pack (this represented one-sixth of the advance ticket sales). Record the entries for the November 3 and November 20 transactions. View transaction last Journal entry worksheet 1 2 4 5 Record the entry for cash sales and its sales taxes. Note: Enter debts before credits General Journal Dobit Credit Dute Jul 15 View general Journal Record entry Clear entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts