Question: Exercise 11-31 (Algorith ) (LO. 8) Noah Yobs, who has $82,600 of AGI(solely from wages) before considering rental activities, has $74,340 of losses from a

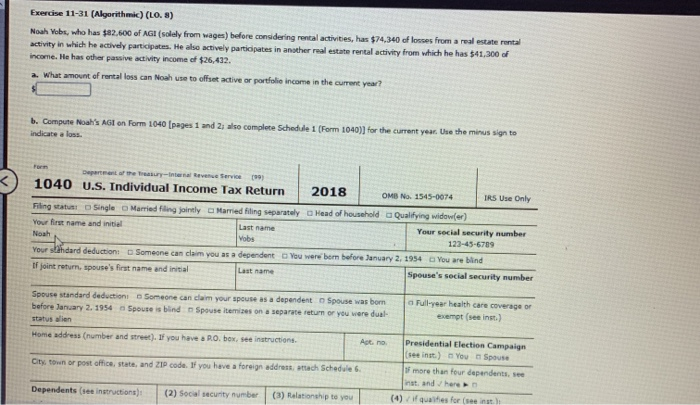

Exercise 11-31 (Algorith ) (LO. 8) Noah Yobs, who has $82,600 of AGI(solely from wages) before considering rental activities, has $74,340 of losses from a real estate rental activity in which he actively participates. He also actively participates in another real estate rental activity from which he has $41.300 of income. He has other passive activity income of $26.432. a. What amount of rental loss can Noah use to offset active or portfolio income in the current year? b. Compute Nol' Alon Form 1040 pages 1 and 2, also complete Schedule 1 (Form 1040) for the current years the minus sit de los menterary Service 1040 U.S. Individual Income Tax Return 2018 OMB No 1545-0074 TRS Use Only Filing status: Single Married filing jointly Married filing separately Head of household Qualifying widower) Your first name and Last name Your social security number Noah 123-45-6789 Your standard deduction Someone can claim you as a dependent you were born before January 2, 1954 You are blind of joint retur, spouse's first name and initial Last name Spouse's social security number Spouse standard deduction before January 2. 1954 status alien Son e can dam your spouse as a dependent Spouse was bom Spousesbind Spouse e es on a separte return or you were dual Fullyear health care coverage exempt (see inst) Home address number and street). If you have a RO box. see instructions Presidential Election Campaign seeint You Spouse City, town or post office state, and ZIP code. If you have a foreign address anach Schedule 6 | more than four dependents see Dependents (see instructions (2) Social security number (3) Relationship to you (1) if qualities for rent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts